How to calculate the transport tax on the gazelle business

The tax and taxation of the Gazelle car is further owned by the organization - the Organization of Property Rights and is accounted for on the balance sheet as the main means - the organization is and pays a transport tax in the Kemerov region. The vehicle is used for the transport of goods. The Gazelle car has a cab with 3 passenger seats and a cargo compartment in the form of a van without passenger seats. What is the transport tax rate to be applied in this case for passenger or cargo vehicles?

VIDEO ON THEME: Transport tax calculation, calculation of the tax by exampleDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

107 hp car tax

The general provisions of the transport tax are further defined in this chapter by this Code and by the laws of the constituent entities of the Russian Federation on taxation, are enacted in accordance with this Code by the laws of the constituent entities of the Russian Federation on taxation and are obliged to pay in the territory of the constituent entity of the Russian Federation. By establishing the tax, the legislative representative bodies of the constituent entities of the Russian Federation shall determine the tax rate within the limits established by this chapter.

In the case of taxpayers-organizations, the legislative representative bodies of the constituent entities of the Russian Federation, in establishing the tax, shall also determine the manner and timing of the payment of the tax; in the establishment of the tax, the laws of the constituent entities of the Russian Federation may also provide for tax benefits and the grounds for their use by the taxpayers; and in the case of taxpayers, the taxpayers ' article further in this chapter shall recognize taxpayers as persons on whom, in accordance with the legislation of the Russian Federation, vehicles recognized as the object of the tax shall be registered in accordance with the article of this Code, unless otherwise provided in this article.

In the case of vehicles registered with natural persons acquired and transferred by them on the basis of a power of ownership and control of the vehicle prior to the official publication of this Federal Act, the taxpayers shall be the person identified in such a power of attorney, while the persons in whom the said vehicles are registered shall notify the tax authority of their place of residence of the transfer on the basis of the authorization of the said means of transport.

Part Three has not been applied since 1 January. It is not recognized by taxpayers to confederations, national football associations, including the Russian Football Union, the Organizational Committee of Russia, the subsidiary organizations of the Organizational Committee of Russia, the producers of media information of FIFA, the suppliers of goods of work, the services of FIFA referred to in the Federal Act on the Preparation and Implementation of the FIFA World Cup in the Russian Federation, the FIFA Cup of Confederations of the Year and the amendment of certain legislative acts of the Russian Federation, with regard to vehicles belonging to them and used only for the purpose of implementing the measures provided for in the Federal Act.

1. Motor vehicles, motorcycles, motorbikes, buses and other self-propelled vehicles and machinery on air and caterpillars, fixed-wing aircraft, helicopters, heaters, yachts, sailing vessels, boats, snowmobiles, moths, motorboats, hydrocycles, non-self-propelled towed vessels and other water and air vehicles are recognized as objects of taxation under the established procedure in accordance with the legislation of the Russian Federation.

1. The tax base shall be determined: 1 for vehicles with engines other than those referred to in paragraph 1. The tax base shall be determined separately for the vehicles referred to in subparagraphs 1, 1.

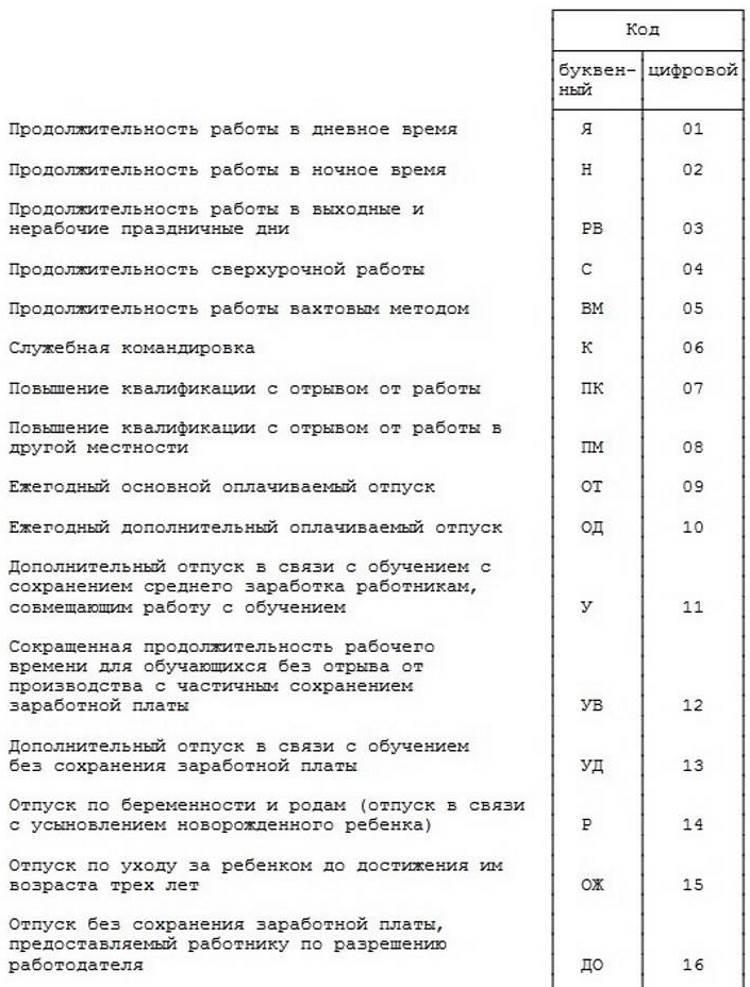

1. Tax rates shall be determined by the laws of the constituent entities of the Russian Federation, depending on the power of the engine, the propulsion of the jet engine or the gross capacity of the vehicle, per horse power of the engine of the vehicle, one kilogram of the traction force of the jet engine, one registration ton of the vehicle or one unit of the vehicle, as follows:

The tax rates referred to in paragraph 1 of this article may be increased by the laws of the constituent entities of the Russian Federation, but not by more than ten times.

This limitation on the reduction of tax rates by the laws of the constituent entities of the Russian Federation does not apply to passenger cars with engine power from each horsepower to l. Differential tax rates are allowed for each category of vehicles, as well as for the number of years since the year of production of the vehicles and their environmental class.

The number of years since the year of production of the vehicle shall be determined as at 1 January of the current year in the calendar years following the year of production of the vehicle; in the event that the tax rates are not determined by the laws of the constituent entities of the Russian Federation, the taxation shall be based on the tax rates referred to in paragraph 1 of this article.

1. Individuals shall be exempt from taxation in respect of each vehicle having a permissible maximum mass exceeding 12 tonnes recorded in the vehicle register of the charging system further in this chapter - a register if the amount of the compensation paid for damage caused by public roads of federal importance to vehicles having a permissible maximum mass exceeding 12 tonnes further in this chapter - payment made in the tax period in respect of such vehicle exceeds or equals the amount of the calculated tax for that tax period.

If the amount of tax calculated in respect of a vehicle with a permissible maximum mass exceeding 12 tonnes registered in the register exceeds the amount paid in respect of such a vehicle in the tax period, the tax exemption shall be equal to the amount of the fee by reducing the amount of the tax by the amount of the fee.

The natural person entitled to the tax benefit shall submit to the tax authority of his or her choice an application for tax relief and documents confirming the tax benefit right of the taxpayer.

1. Tax contributors shall calculate the amount of the tax and the amount of the advance payment on their own.

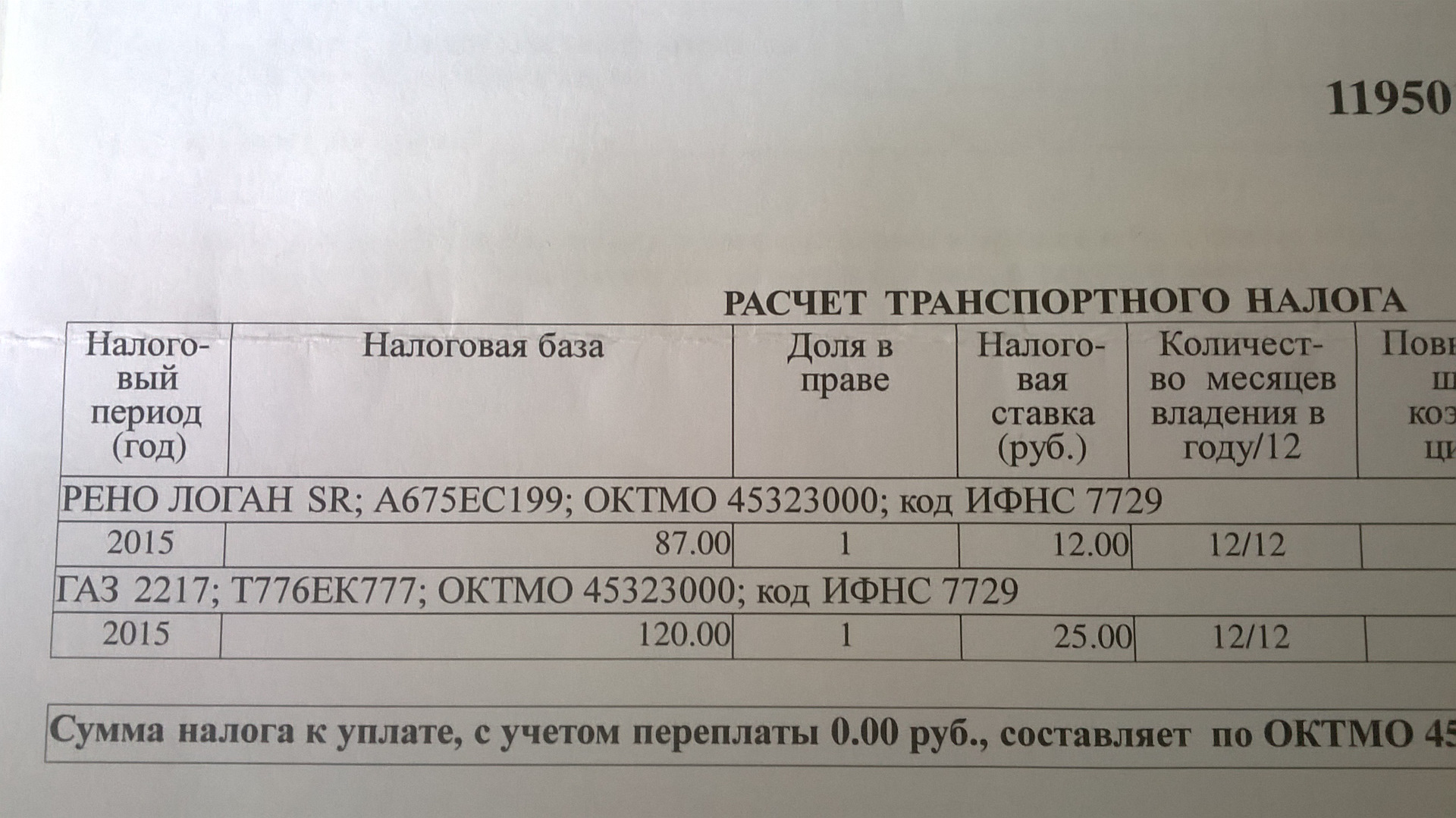

The amount of tax payable by natural taxpayers is calculated by the tax authorities on the basis of information submitted to the tax authorities by the authorities responsible for State registration of vehicles in the territory of the Russian Federation.

The amount of the tax to be paid to the budget from the tax period shall be calculated for each vehicle as a work of the appropriate tax base and tax rate, unless otherwise provided for in this article.The amount of the tax to be paid to the budget by the taxpayers-organizations shall be determined as the difference between the amount of tax calculated and the amount of tax advances payable during the tax period.

The tax is calculated on the basis of an upward factor: 1.1 for passenger cars with an average value of between 3 million and 5 million roubles, inclusive of which between 2 and 3 years have passed since the year of production; 1.3 for passenger cars with an average value of between 3 million and 5 million roubles, inclusive of which between 1 and 2 years have passed since the year of production; 1.5 for passenger cars with an average value of between 3 million and 5 million roubles, inclusive of which no more than 1 year of production; 2 for passenger cars with an average value of between 5 million and 10 million roubles, inclusive of which no more than 5 years of production; 3 for passenger cars with an average value of between 10 million and 15 million roubles, including 10 years of production; and 3 for passenger cars with an average value of between 15 million roubles, not more than 20 years of production.

The calculation of the time limits referred to in this paragraph shall begin with the year of production of the respective passenger car, and the calculation of the average cost of passenger cars for the purposes of this chapter shall be determined by the Federal Executive Authority, which shall be responsible for the formulation of public policies and regulations in the field of trade.

The list of passenger cars with an average value of 3 million roubles to be used in the next tax period shall be posted no later than 1 March of the next tax period on the official Internet site of the said authority; the tax amount resulting from the tax period by the taxpayers-organizations for each vehicle with a permissible maximum mass exceeding 12 tonnes registered in the register shall be reduced by the amount paid in respect of such vehicle in the tax period.

In the event that, in the application of the tax deduction provided for in this paragraph, the amount of the tax to be paid into the budget accepts the negative value, the amount of the tax shall be taken to be zero.

The information from the register shall be submitted to the tax authorities every year until 15 February in a manner determined by the Federal Executive Authority in the field of transport, in consultation with the Federal Executive Authority, which is responsible for monitoring and supervising taxes and charges, and the tax contributors shall calculate the amount of the tax advances at the end of each reporting period in the amount of one fourth of the tax bases' work and the tax rate, taking into account the increase factor referred to in paragraph 2 of this article.

In the case of registration of a vehicle and or removal of a vehicle from the register of deregistration, deregistration from the State ships' register, etc., if the registration of the vehicle took place before the end of the relevant month, or withdrawal of the vehicle from the register, deregistration from the State ships' register, etc., the full month of registration of the withdrawal from the registration of the vehicle shall be taken as the month of registration.

If the registration of the vehicle takes place after the end of the month in question or the withdrawal of the vehicle from the register, the exclusion from the State ships' register and so on up to and including the end of the month in question, the month of registration of the withdrawal of the vehicle shall not be taken into account in determining the coefficient referred to in this paragraph; has lost force; the legislative representative body of the entity of the Russian Federation, when establishing the tax, may provide for the right for certain categories of taxpayers not to calculate or pay advance tax payments during the tax period.

1. Tax and tax advance payments shall be made by taxpayers to the vehicles' home budget, and the procedure and time limits for tax and tax advances for taxpayers-organizations shall be established by the laws of the constituent entities of the Russian Federation.

However, the tax period may not be fixed earlier than the period provided for in paragraph 3 of the article The tax shall be paid by natural taxpayers no later than 1 December of the year following the tax period; during the tax period, the taxpayers/organizations shall pay advance tax payments unless otherwise provided by the laws of the constituent entities of the Russian Federation; and upon the expiration of the tax period, the taxpayers/organizations shall pay the tax amount calculated in accordance with the procedure provided for in paragraph 2 of article 2 of this Code.

Tax contributors to an organized vehicle with a permissible maximum mass exceeding 12 tonnes registered in the register shall not pay the estimated advance tax payments, and natural taxpayers shall pay the transport tax on the basis of the tax notice issued by the tax authority.

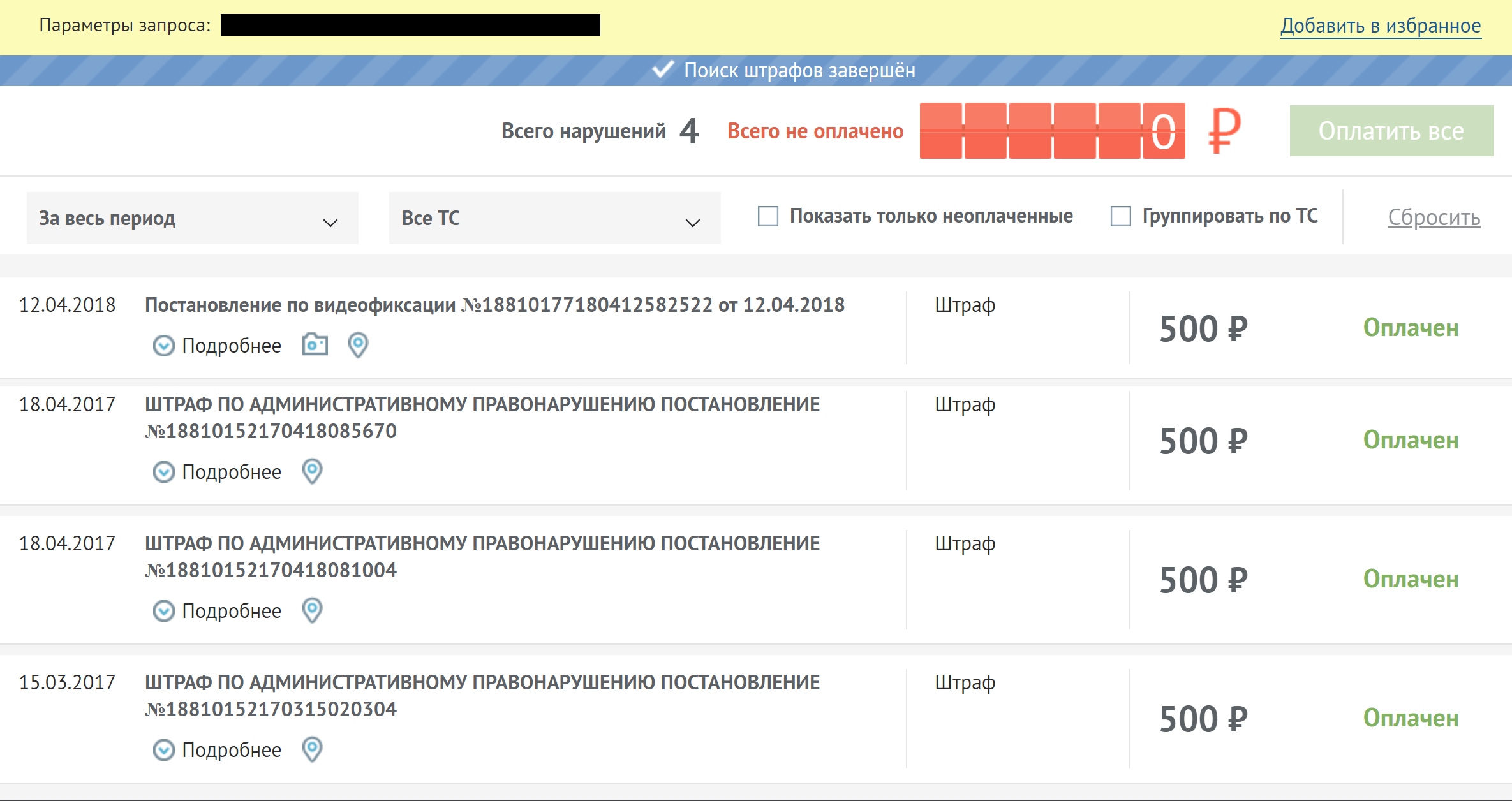

No more than three tax periods prior to the calendar year of its issuance shall be allowed for the issuance of a tax notice, and the taxpayers referred to in paragraph 1 of this paragraph shall pay no more than three tax periods prior to the calendar year of the issuance of the tax notice referred to in paragraph 2 of this paragraph.

The refund of the amount of the tax overpaid for the recalculation of the tax shall be made during the period of such recalculation in accordance with articles 78 and 79 of this Code.

At the end of the tax period, tax-payers submit tax returns to the tax authority of the vehicles' location. Abzac II is no longer in force. As of 1 January, tax returns are submitted by tax-employers no later than 1 February of the year following the tax period.

Abzac II has been in force since 1 January. In accordance with article 83 of this Code, the tax-payers, who are classified as the largest, submit tax returns to the tax authority at the place of registration as the largest taxpayers.

Minfin told me to pay the Gazeli tax as a truck.

Although they belong to the category of passenger cars, the tax should be calculated on the basis of the rates for trucks; this will not lead to a significant increase in taxes paid by small businesses; in the opinion of one of the owners of the GAZ van that went to the Ministry of Finance, the international Convention on Road Traffic, ratified by the USSR, should be applied in determining the category; the same category is indicated in the passport of the same vehicle; in the Department of Tax and Customs Policies of the Ministry of Finance of the Russian Federation, there was general support for the owners' arguments, recognizing the priority of the international convention.

Even if there is a category B vehicle in the vehicle's passport, the question is that the personal owner of the vehicle is Gazelle. Under the passport, the type of TS is a cargo van with seven seats. In order to apply the transport tax rates correctly when a vehicle is assigned to one category or another, it should be noted that the heading is given. At what tax rate should the transport tax be calculated from the car Gazelle?

Transport tax in 2019: major changes in Russia

The general provisions of the transport tax are further set out in this chapter by this Code and by the laws of the constituent entities of the Russian Federation on taxation, which are implemented in accordance with this Code of Tax Laws of the constituent entities of the Russian Federation and which are obliged to pay in the territory of the constituent entity of the Russian Federation. In establishing the tax, the legislative representative bodies of the constituent entities of the Russian Federation shall determine the tax rate within the limits set by this chapter. In the case of taxpayers, the legislative representative bodies of the constituent entities of the Russian Federation shall also determine the procedure and the time frame for the payment of the tax. In the establishment of the tax, the laws of the constituent entities of the Russian Federation may also provide for tax exemptions and the grounds for their use by the taxpayers; the article of the taxpayers of the tax shall further specify in this chapter that taxpayers shall recognize the persons on whom, in accordance with the legislation of the Russian Federation, vehicles recognized as subject to taxation shall be registered in accordance with the article of this Code, unless otherwise provided by this article; in the case of vehicles registered on the basis of their authorization to own and dispose of the vehicle until the official publication of this Federal law, the taxpayers shall be recognized by the person on the person named on the transfer of the means of his or her or her or her or her or his or her or her or her vehicle on the said person on the means of his or his or his or her or her or her.

Transport tax calculator online

In order to pay a transport tax, the Gazelle vehicle is considered a truck, explained by the Ministry of Finance, which was circulated by the Ministry of Finance. In a letter dated 21 October, although the Convention on Road Traffic requires that the car be considered light, the Ministry of Finance disagrees with this. According to the Internet publication " Driver of Petersburg ", Minfins' position will not cause a significant increase in payments for small businesses: such an explanation, if used by the tax authorities, will force the owners of popular Gazelles to pay higher freight taxes, but the difference will not exceed 15 per cent.

The transport tax for legal persons is a regional tax and is established by the laws of the constituent entities of the Russian Federation. The same laws define the procedure and timing for its payment. For you, we have prepared detailed guidelines on how to calculate the transport tax in a year.

How to Calculate Car Tax - 2018

The transport tax calculator who pays the motor vehicle tax is paid by the persons and organizations on whom the following vehicles are registered: motor vehicles, motorcycles, motorbikes, buses and other self-propelled vehicles and machinery in the air and caterpillars, aircraft, helicopters, heaters, yachts, sailboats, boats, snowmobiles, moths, motor boats, hydrocycles, non-self-propelled towed vessels and other water and air vehicles registered under Russian law.

SEE THE TIME: How to calculate the transport tax?The transport tax rate is calculated according to the formula: the tax rate depends on the power of the engine, the capacity of the vehicle, the category of the vehicle and the year of its production. The rate may vary from region to region, from each horse force of the motor car to l. For example, the tax rate in Moscow is fixed to that of the power of the car. Lighters with the power of the engine; the tax on each horse force up to l. The tax base is the power of the engine in the horsepower.

The Gazeli transport tax is paid as a truck, not as a car.

.

.

.

.

.

.

.

.

5

5

I'm joining you, and I'm dealing with it, so we can talk about it.

Smart girl.