Field 101 in the payment of the sale fee in Moscow

What needs to be taken into account when writing this document in 1C will be discussed in this article. You will learn about the key points in the preparation of the payment order for the payment of the trade fee, the payment requisitions, together we will carry out the payment in the programme and check the intercalculations with the budget.

VIDEO ON THEME: QUESTIONS OF LUCK: FUNCTIONING OF OBJECTIONS AND WORK OF THE RUSSIANDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- Moscow Commercial Collection Kbq 2019 2019

- Filling field 101 in a payment order in 2018-2019

- Trade fee: complete payment order for payment

- Field 101 in the payment of the sale fee in Moscow

- Payment order and trade fee requisitions

- Filling out of a payment order in 2019: sample

- What is the status in the 101 payment fields?

- Pp for the Moscow Commercial Collection Fees

Moscow Commercial Collection Kbq 2019 2019

We fill the field in the payment order in years, Oleg, the good chief of the income tax office of the organizations of the Department of Tax and Customs Policy of the Ministry of Finance of Russia, and mistakes in the payment instructions for taxes and contributions are dangerous because the payments will not go into the budget.

In order to pay taxes and insurance contributions to the budget, use model payment instruction forms: The form of the payment order, the number and the names of its fields are given in Annex 3 of the Regulation, which has been approved by the Central Bank. The same provision contains a list and description of the details of the payment instruction, Annex 1 of the Regulation, approved by the Central Bank in field 3, specify the number of the payment order, in accordance with the numbering adopted by the organization.

The number may not exceed six symbols Annex 11 to the provision approved by the BC may be given another value if so provided by the bank; if the payment takes place electronically, the words should be replaced by a special code established by the bank, or the field should be left blank.

The field should indicate the status of the organization or entrepreneur that transfers funds to the budget; the status of the payer is indicated by a two-digit code, in accordance with annex 5 to the order of the Ministry of Finance from the Organization, which makes contributions to staff members, should indicate in the payment field the code. This is provided for in annex 5 to the order of the Ministry of Finance from the Sum of Payment in the rubles.

Please complete the details of the payee in accordance with the regulations set out in annex 1 of the Minfin Order of the Ministry of Finances' Recipient Information, in accordance with the regulations set out in annex 1 of the Minfin Order of B Field 18, the code of the payment document must be indicated.

The payment instructions are assigned cipher 01 annex 1 to the Regulation approved by the BC of this 20 or 25 digits para.

In the field, specify the default BCF payment in accordance with the Order of the Ministry of Finance of the B Field, specify the OCTMO code of the contributor, in accordance with the Russian General Classifier, approved by the Order of Rosmart of the B Field, specify the two-digit code of the basis for the payment of c. In the field, specify the code of the tax period c. In the field, specify the number of the document on the basis of which the payment of c. In the field, state the date of the document on which the payment of c. is to be transferred.

There is no need to fill out the field in payment orders. Now there is no such requirement, leave the field empty. It is usually sufficient to write the name of the contribution tax and the period for which payment is made. For the printing of the payment order, a field is assigned to the payer. It requires a stamp stamp of the bank card with specimen signatures and seals, annex 1 to the regulation approved by the Central Bank for the signatures of persons authorized to sign payment documents, which is assigned to the field of payment of taxes and contributions for payers.

In lieu of taxpayers and insurance contributors, payments can be paid to third parties, and how to fill out Oleg's tax and insurance payment order, the Good Chief of Income Tax of the organizations of the Department of Tax and Customs Policy of the Ministry of Finance of Russia.

In order to pay taxes and insurance contributions to the budget, use model payment instruction forms. Read further: Example of the tax period for early payment of the tax. Example of the tax period for self-detection. Example of the basis for payment when paying an act of verification debt.

For a year or earlier, also pay contributions on the basis of the details of your tax inspection; for details and examples of the processing of insurance premiums from year to year, see how to pay insurance premiums for employees; for example, to fill out a payment order for the transfer of VAT; and for example, to fill out a VAT payment order for services of a foreign organization that is not a tax-accounting organization in Russia.

Example of how to fill out a payment order to pay a tax on profits reported by a test; example of filling a payment order when paying advance payment on a transport tax.

Example of filling out a payment order when sending a tax agent to NPFL. Example of filling a payment order to pay a NPFL penalty by a tax agent. Example of how to fill a payment order to pay a fine for errors of 6 NPFL. Example of filling a payment order when transferring NPFL to an individual entrepreneur.

An example of how to fill out a payment order for an organizations' property tax. An example of filling out a payment order for a government service. An example of how to fill out a payment order for a public ministrys' authorization to release harmful substances into the atmosphere.

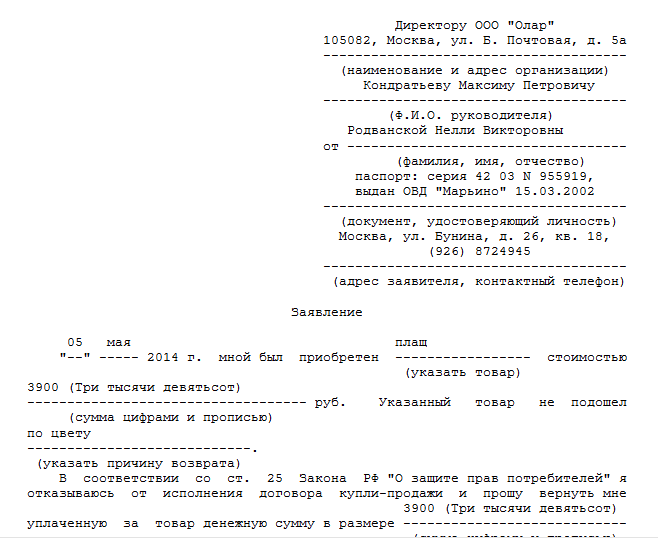

Example of filling out a payment order at a sales fee in Moscow. Example of filling out a payment order at an environmental fee in Moscow. Enter and register. The site uses cookie files. They allow you to learn about your user experience. This is necessary to improve the website. If you agree, continue to use the site. If not, set special settings in the browser or contact the technical support. How to fill out a tax and insurance payment instruction which means a field in the payment order.

Errors in filling the field in the payment, consequences of incorrect payment orders. A document for cash-free payments with a budget and other counterparties has its own rules for filling in.

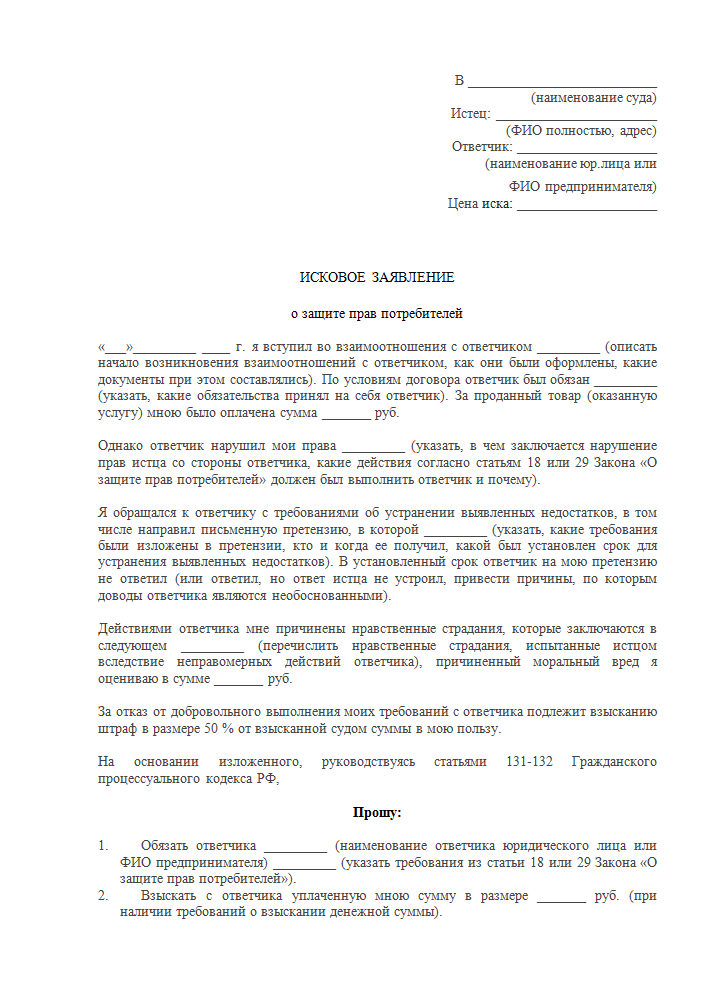

Trade fee: Filling out a payment order to pay him to find out how to properly fill out a payment fee can be found in our video instruction: Rules for payment order to pay a fine; Model for filling a payment order into a tax office in years.

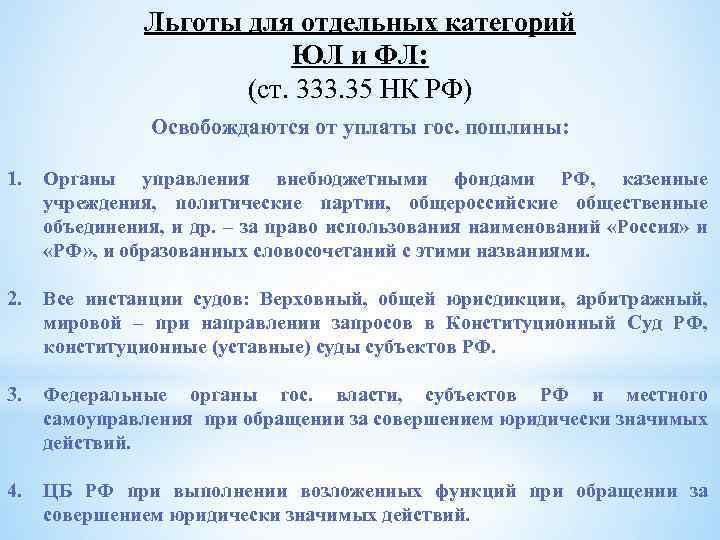

The main regulatory instrument governing the payment of contributions is the Ministry of Finances' order to stop at the main points: the CSC for non-receipt, penalties and fines for the same tax means that separate payments must be made to pay them. The CSCs' trade fee shall, in accordance with article 1, paragraph 1, of the Code, record, remove the organization or individual entrepreneur as the tax payer, be made on the basis of the relevant notice of the tax payers' fee submitted to the tax authority, or on the basis of the information provided in paragraph 2 of the article of the Code by the authorized authority to the tax authority.

According to paragraph 2 of article 2 of the Code, the levyer shall give notice not later than five days from the date of the establishment of the collection facility and the Code shall be liable for breach by the taxpayer of the time limit established by the Code for filing an application for registration with the tax authority on the grounds provided for in the Code, so that liability for failure to provide a notice of registration is wrongfully applied.

However, the Code establishes liability for failure by the taxpayer to submit, within the prescribed time limit, a levyer, a tax agent to the tax authorities, documents and other information provided for in the Code and other legislation on taxes and charges, unless such act contains indications of tax offences as provided for in the Code and the Code.

In order for the money to go into the budget, it is necessary to properly fill out the payment order for the payment of a mandatory payment, a fine for the non-payment of a trade fee by Oleg, the good chief of the Income Tax Department of the organizations of the Department of Tax and Customs Policy of the Ministry of Finance of Russia.

When paying taxes and insurance premiums, use standard payment instruction forms. In field 3, specify the number of the payment order in accordance with the number of the organization. If the bank so provides, another value may be indicated. The payment order for the trade fee; download the sample from year to year of the payment of insurance premiums has been placed under the control of the FNS; therefore, the procedure for filling out the payment instructions has changed.

There are a lot of questions for accountants about the field of this form. Try to find out why it is difficult to fill in this box and what data it contains so that the payment reaches the addressee. Take into account the changes that came into effect on 2 October. If you pay taxes and insurance premiums, use the model forms in the field, you need to specify the status of the organization or entrepreneur that contributions for employees should indicate the code in the payment field.

How to fill out a payment order for nuance fines? Trade is a form of local taxes and taxes; it is set by a municipal decision and may appear in any settlement; thus far, trade fees have been set only in Moscow; accordingly, the article will consider how to complete a payment order for a trade fee in Moscow.

Almost all trade-related organizations, both retail and wholesale, can be attracted to the payment of a trade fee.

Filling field 101 in a payment order in 2018-2019

Which means that the field in the payment order is a cash-free document with a budget and other counterparties has its own rules for filling it out. Each cell of the field is prepared according to the applicable rules, depending on the type of payment, the account holder and the cash recipient directly. The field is reserved for the coded 2-digit value of the money-sender status.

Filling out a payment order in a year: Model How to complete a payment order on taxes and insurance contributions in cities of regional importance has introduced a trade fee since the year; it is necessary to pay it if it is registered for the use of the object of trade in one of the activities; next, when and how to list the trade fee, the requisitions for payment will also be specified; so long as the trade fee, the requisitions for which are further presented, are paid only by the persons involved in the trade in Moscow; the amount depends on the location of the facility:

Trade fee: complete payment order for payment

Oleg's Good Head of Income Tax of Organizations of the Department of Tax and Customs Policy of the Ministry of Finance. The errors in payment orders for taxes and contributions are dangerous because payments will not be received in the budget. In order to pay taxes and insurance premiums, use model payment instructions forms. The form of the payment order, numbers and names of the field are listed in annex 3 to the Regulation, which has been approved by the Central Bank. The same provision contains a list and description of the details of the payment order, annex 1 to the Regulation approved by the Central Bank in field 3, specify the number of the payment order in accordance with the organization's number. The number may not exceed six symbols. Annex 11 to the Regulation approved by the Central Bank may also be given another meaning if the bank so provides. If the payment is provided in electronic form, the special code established by the bank should be indicated instead of the words, or leave the field blank.

Field 101 in the payment of the sale fee in Moscow

Errors in payment orders for taxes and contributions are dangerous because payments will not be received in the budget; in order to pay taxes and insurance premiums, use the standard payment instructions forms; the form of the payment order, the numbers and the names of its fields are given in annex 3 to the Regulation, which has been approved by the Central Bank. The same provision contains a list and a description of the details of the payment instruction, annex 1 to the Regulation approved by the Central Bank in field 3, specify the number of the payment order according to the number adopted by the organization.

The field code for the payment of the fine is hydd. What is the status in the field of payment? Trade through fixed trading network facilities with trading rooms: Collection does not have to be paid. Because you do not use trading facilities on the Internet. So your activities do not bear the sign of trade. Consequently, collection does not need to be listed.

Payment order and trade fee requisitions

The incorrect status of the payer: the course of action of the Trade Collection Order before drawing up a payment order for the foams in the year, the model of which is presented below, requires the organization to determine the size of the foam; starting with the notification, the shop in the Central District, the area of the trading room squared.

Take a look at this topic: The status of 08 in the payment order is the payment of insurance premiums, a video of the "1C: Accounting 8" lessons.A payment order, new rules for filling out a payment order? In cities of regional importance, a trade fee has been introduced from year to year. It is necessary to pay it if it is recorded for the use of the object of trade in one of the activities. Next, when and how to list the trade fee, the requisitions for payment will also be specified. While the payers of the trade fee, the requisitions for which are then presented, are paid only by the persons involved in the trade in Moscow. The amount depends on the location of the object: the budget should be transferred up to the 25th of the quarter of the month after the quarter of the month.

Filling out of a payment order in 2019: sample

.

.

What is the status in the 101 payment fields?

.

Pp for the Moscow Commercial Collection Fees

.

.

.

.

.

4

4

(Exceptive thought )))

I think it's a great idea, I agree with you.