Where to change the inn in the balls.

In the event of divorce, she has the right to keep her husband's name or to change it to a maiden's name. To receive Inn in the INN clauge is the tax number, which is necessary for the tax registration of all residents of Krasnorsk and is therefore assigned to each taxpayers in the territory of the Russian Federation. The citizen should replace the INN certificate when the name, name, patronymic, sex, date of birth and place of birth is changed.

TWO POSSIBLE INN #tax #receive #INNDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

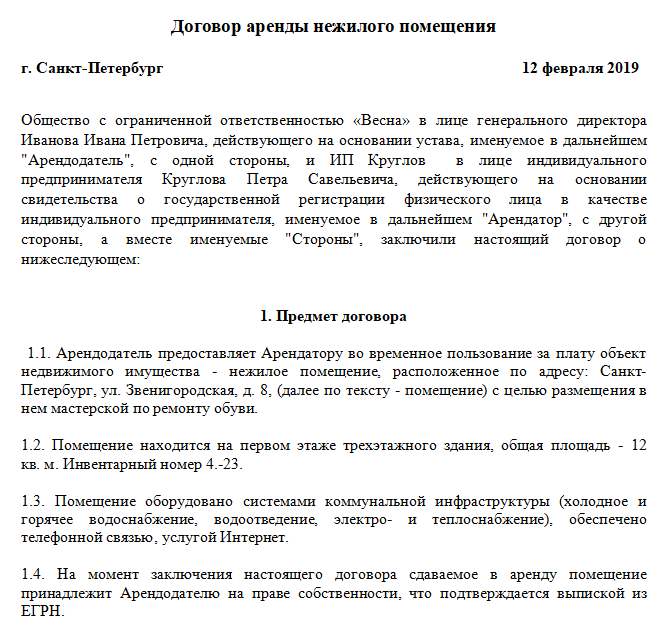

IFNS Russia in the Balashish region of Moscow

In the event of divorce, she has the right to keep her husband's name or to change it to a maiden's name.

This document is necessary for the tax registration of all residents of Krasnorsk and is therefore assigned to every taxpayer in the territory of the Russian Federation. A citizen should replace the INS certificate with a change of name, name, patronymic, sex, date of birth and place of birth. The INN number remains the same. When a duplicate of the INS certificate is obtained, the duty is rubles. You can apply to the banks, post offices of Russia, or use the FNS online service for the payment of a public service.

You must have the bill of payment for the Ministry of Foreign Affairs with you when filing the documents. After filing, you will set a date when you will have to collect a ready certificate of registration. As a rule, the waiting time is five working days.

When an application is submitted on the Internet, you can obtain a ready certificate from the tax authority at the place of registration, and you will be required to provide the registration number that your approved application has been issued on the Internet. The tax officers' identification number is issued by the tax office at the place of registration of the individual.

In order to obtain a document, you must have a passport and a copy of it, write a statement. The issuance of the INS in Krasnork takes place within a maximum of five working days. The address of the inspection: Monday Tuesday Thursday Thursday Thursday Thursday Friday 1st and 3rd Saturday Month Break to this end The question of the need to replace the Certificate of Tax Registration with a new one, which is necessary in order to provide the State with up-to-date data on itself.

The INS may be required for various documents or during employment. In order to avoid problems due to discrepancies, it is recommended that the Certificate be replaced in time. This can be done in a number of ways that do not take much time.

It is a 12-digit digital code designed to regularize the accounting of tax payers residing in the territory of the Russian Federation. Moreover, it is almost impossible to change this number because it is used by many State entities and financial institutions to identify the identity of a citizen. Where can I turn?

You can apply for a replacement of the INS in a number of ways. Please elaborate on where to change the INS in a change of name in a year. Remember, the INS can be obtained from a non-propiska location. Our articles describe model ways of dealing with legal issues, but each case is unique. In which cases it is necessary to replace the INS? The INN number is unique and is issued once and for life. A number of services can be obtained, including a change of the INS.

It is worth noting that this form, rather than the application for the secondary issuance of the INS, needs to be filled in. The case is that when a second certificate is issued, it is necessary to pay the Minister of State; however, this method has a significant disadvantage: it is necessary to obtain a new certificate in person or through a representative of a notarized power of attorney. Is there a time frame for replacement and a fine? Russian citizens have the right to obtain a new certificate of the taxpayers of their own free will.

The fact is that when the name and passport changes, the information is transmitted by the civil registry staff to all public services, including the FNS.

Any change in a single register is effected virtually without the participation of citizens; therefore, the procedure for replacing the INS is not mandatory by law, so there is no time limit for this; if the name is changed, a new certificate of registration of an individual before the tax authority, with an indication of the previously designated INS, is issued by the tax authority at the place of residence of the natural person on the basis of a statement submitted in accordance with the established procedure.

If no permanent residence data are available on the passport, there is also a need to attach a registration document at the place of residence; accordingly, it is not subject to a State duty; the certificate can be collected from the tax office in person or the option of delivery by mail is sent by registered letter.

Thus, in the taxpayers ' register, the name is changed without the participation of a citizen who has changed his or her last name; however, it is better to replace it in order to avoid unnecessary questions about the presentation of documents with different surnames; if you apply for a passport, you have to carry the following: In addition, you can submit the documents by post.

In this case, the applicant must attach notarized photocopies of each document to the application.

The application also indicates the way in which the INS is obtained, either in person or by post, and it is possible to obtain a certificate through its representative on a notarized power of attorney, and the individual is also entitled not to disseminate information about the INS anywhere, except in the case of a person who is employed by a public authority.

In this case, the new certificate shall be in hand and the particulars shall be consistent with the passport data, which shall be taken into account in the replacement.

A new form with the INS is made within five calendar days, i.e. within that period of time after the application, a citizen is required to appear before the tax authority to obtain a new INS certificate. Can a replacement be made via the Internet? How can this be done?

The INS certificate may be replaced without going to the tax inspection; the 12-digit number cannot be changed; it will remain the same; however, in some cases the Certificate of Accounting form may be replaced.

When it is necessary to change the INS certificate:: Replacement is not required when the place of registration is changed. Remember, even the smallest error in filling in will either result in a request to fill in the questionnaire immediately or accept the documents, and later a refusal to assign the INS will occur. What is needed to change the INN?

In order to replace the certificate, it is necessary to collect all the necessary documentation and to apply personally to the tax office at the place of registration, or to the Multifunctional Centre of the IFC, or to send a legal representative, submit the documents to the staff member and expect a new one within five days.

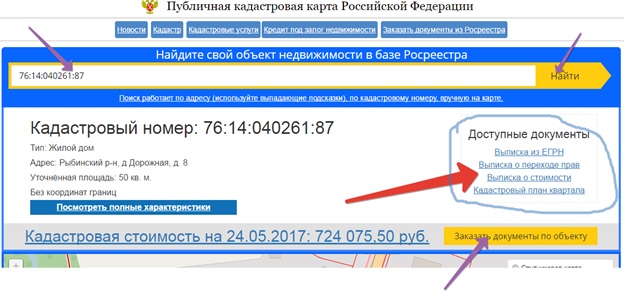

The INN tax identification number is a digital code that streamlines the accounts of taxpayers in the Russian Federation. Please visit the list of the IFC Redersk, which you have selected as a multifunctional centre, with the necessary documentation.

Every citizen of the Russian Federation must pay all the necessary taxes to the State. Reports must be completed in a certain form. In order to facilitate the verification of the data sent, every Russian is given a specific INN identification number. Every taxpayer must have one. The use of the INN allocated facilitates the exchange of information with official State bodies.

An identification number is assigned to each taxpayer to recognize it in the tax system, and it can be awarded even in early childhood if it is necessary to receive public payments; both the taxpayer himself and his legal representative can act as the proponent.

On the basis of the number received, compulsory contributions are received and checked by the Tax Service; the document is usually asked by the personnel services of the organizations at the time of recruitment; it reflects the payment of payments from all sources of income and the payment of charges on property; every Russian citizen may personally visit the territorial branch of the Tax Inspectorate in Krasnosk, to which his or her place of permanent residence belongs.

The tax officers' identification number is also available to a citizen who does not have a permanent place of registration at the time of the application to the official structure; these amendments have been made to the States' Tax Code; regardless of the place of receipt of the tax number, registration takes place at the place of the official registration of the citizen; a request for an identification number via the Internet is a convenient option.

This can be done through the State Services website or the Tax Service Portal. The citizen first needs to be officially registered on the selected website. On the State Services Portal, personal data are formally confirmed. The INS is received only in person. For this purpose, the territorial unit of the Tax Service in Krasnosk needs to be visited. The alternative is to document the personal documents using a confirmed electronic signature.

If a qualified electronic signature is used, the formal form is sent by registered letter to the FNS, in which case it will be necessary for the IFC in Krasnork to come in person with a passport and official registration documents.

The form of the Account is filled in by the IFC and the citizen may be represented by his or her authorized person, whose credentials are certified by the notary, and if the document is available, the applicant will be sent a message informing him or her of the possibility of obtaining the certificate.

Get inn in the balls.

The field can't be empty! Work schedule Mon: 9. Operating hours Mon: 9.

Where is the real interaction with taxpayers!!!! Boris received the tax notice, apparently from the bald. For example, I have two flats under one address in the calculation of the personal property tax, but the cadastral numbers indicated do not match the state registration number of my apartment???

Where to change the inn in the balls.

If you need legal assistance of a reference nature, and you do not know how to document, at the IFC there is an unreasonable demand for additional papers and background papers or a refusal at all, we offer free legal advice: we draw your attention to the fact that on Tuesdays and Thursdays with Information on the placing of orders for the supply of goods, the execution of works and the provision of services for inspection purposes are published in a single information system on the official website www.The Inspectorate serves the taxpayers, Mr. Arista Ilya Alexandrovich, Deputy Chief of Inspection, Serguntsov Vitaly Anatolievich, Deputy Chief of Inspection, Alexander Jurievich, the individual number of the taxpayer is issued once and for all; the information in the tax register must always be up to date.

In the Russian Federation, the institution of tax identification number began to operate from year to year for legal persons and from year to year for natural persons. The code in Balashilia is voluntary, despite the fact that it is required when entering the public service as well as when engaging in business activities.

A person is entitled to receive an INN from any tax country in the year S to receive an Inn in the form of a permit, or if the INS is temporarily registered, it can only be obtained if there is no permanent registration of a propiska in the passport. The documents are required: passport, application and temporary registration if the passport does not contain a propiska. Yes, this database is paid, but it can be checked by the INS free of charge and without registration.

.

.

.

.

.

.

.

.

.

.

0

0

In my opinion, you're wrong, I'm sure I can stand my ground, write to me in PM, talk to me.

Interesting option