No tax on the sale of aqtsma for 3 years

Here are some examples of this kind of expense: the costs that need to be recovered from a certain member of the stock market, the payment of financial fees by the stock exchange, and how the non-negative outcome is defined. The result will require the use of a formula to determine a person's financial outcome.

THEME: Real estate taxes: when, what, how manyDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

How is the share tax calculated on the sale of physicals?

The payment of a sales tax Sales Tax is a tax that is imposed on the State on natural and legal persons when selling works, goods or services.

As has already been said, this will be a regional tax, and it will depend on the authorities of the entities to impose it again or not. Like other taxes, sales tax has its functions: the tax function Explaining the Financial Function is to collect and generate money for the maintenance of the State apparatus, science, the army and other public services. The economic function is to influence economic agents by encouraging and controlling the various business processes of our country.

When a consumer buys the goods, it is charged to the seller, who then pays it to the local budget.

This tax is the third tax imposed by the State to increase the flow of money to local budgets, which was minimal, and soon the tax was abandoned, replacing the VAT.

At the autumn session, a draft law on the introduction of this tax will be considered, and when a sales tax is introduced, it will be paid by legal entities and individual entrepreneurs who trade in goods, works and services on the territory of the Russian Federation.

There is no such tax for natural persons, since the sale of personal effects or the sale of a room or other real estate, the individual pays income tax, but the local authorities are obliged to draw up a package of benefits to be applied under the tax.

At the federal level, the sales tax will be regulated by gl. Less this innovation is that there will be double taxation of the products sold, VAT and sales tax, and although the introduction of the sales tax does not affect the equilibrium of the consumer, the product sellers in some regions will experience this innovation.

We've got him, and he's getting paid properly, and we needed the money to raise more money, and the low efficiency of the tax at the time was due to the fact that the tax was not in effect in all regions.

It was introduced in cities of federal importance, Moscow and St. Petersburg, and in several other areas, and it was abolished by the Constitutional Court, which ruled that the payment of this tax by the IP violated their constitutional rights.

In its definition, it held that the payment of the IP tax, which buys products to carry out its activities, was a direct violation of the Constitution, a definition of which the COP had made it difficult to administer the tax; according to this document, each seller of the goods must determine the status of the buyer.

From the beginning of the new year, this tax will have to be paid by all legal entities that apply the common tax system, but before paying the tax, the federal authorities must issue a law that will give effect to the tax on the territory of the entity.

Like any other tax, sales tax has its own characteristics. Individuals are not sales tax payers. It's important to know how income tax is levied when selling property that you own for less than three years.

If the owner of the gift is the payer of the personal income tax, he or she is entitled to a property deduction on the sale of his or her property, which has been owned for less than three years.

The owner of the property may take a different form of deduction, and may reduce the tax base by the amount of the expenses he incurred in buying the property, for example by the amount he paid to the previous owner. If the property has been sold for less than it has been bought, there is no obligation to pay the tax.

The material gain arises if you first buy a currency and then sell it at a rate that deviates from the official exchange rate of the Russian Central Bank on the day of the transaction.

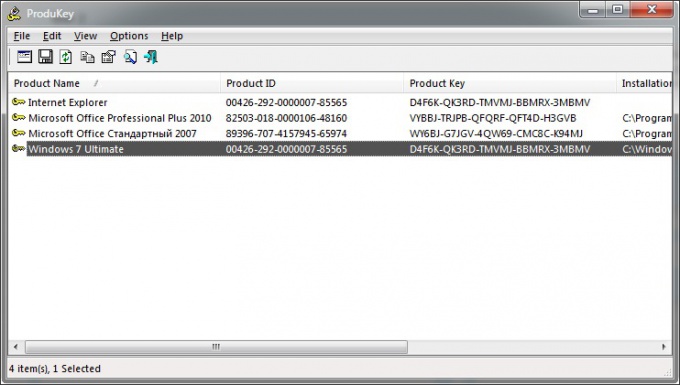

Legal entities, however, include the exchange difference obtained in the execution of such transactions in the income that is accounted for in the taxation of profits, from which a fund will be created to finance the development of domestic software. Enterprises that will develop and sell Russian software will be exempted from the payment of sales tax. Such measures should encourage Russian programmers to produce modern Russian software to replace foreign software.

The sale of securities by a natural person is the result of the latters' income, which is referred to in article 1. However, it is also possible to apply to the sale of securities the property deduction provisions of the NC of the Russian Federation.

It is possible to reduce the amount of income from the sale of securities by the cost of their purchase, although the owner of the shares has owned them for more than three years, he cannot apply a property deduction to the full value of the shares sold.

Legal persons, on the other hand, include the proceeds from the sale of shares into the proceeds, which are taken into account in the taxation of profits; the first way is if the business is owned by more than one owner.

In any case, the seller has a taxable income; he is entitled to a deduction of property; and if the owner has owned a share of the capital for more than three years, he is entitled to a deduction of the full amount of the sale of the share.

If the business is sold as a property complex, then a sales contract must be concluded. In this case, not only is the business sold, but the business debt is sold. In this case, the tax base will be the income from the sale, which will be reduced to the cost of the business. If the owner of the business, the income from the sale will be included in the taxable profits, and the cost of starting the business will be included in the expenses that reduce the tax base on the profit tax.

With regard to the introduction of sales tax into tax turnover, future payers have many questions: the bill states that enterprises that apply special tax regimes are exempt from the payment of sales tax in its entirety.

In the opinion of our deputies, the introduction of a sales tax will not only involve cash calculations, but also cashless ones. This tax will be included in the final value of the goods that the buyer pays, but in what way, cash or non-cash, it is not important. This tax will then be transferred by the seller to the local budget. If the IP applies one of the preferential tax regimes, it will not pay the tax either.

Otherwise, if a generic IP is not a small enterprise, it will have to calculate and pay the tax from 01 January, and it is necessary to know how future sales tax differs from VAT.

These are both indirect taxes that are levied on the buyer and paid by the seller of the goods. However, the difference is there. The VAT is charged to the federal budget and the sales tax is only to the local ones. The sales tax is charged at the retailing stage, where the risk of evasion is high. The costs of administering the tax are therefore high. The rates below this mark will result in a deficit of local budgets. But above 10 in our country are VAT. It is not possible to apply 2 taxes with such high rates.

Many countries have refused tax on VAT sales. No country in the world has both taxes at the same time. This will happen for the first time in our country. The tax on sales is not new to our country, but its introduction has never worked, and even though the lawmakers claim that they have completed the law that was issued in the year, tax and financial experts anticipate an emergency tax tax.

In addition, there is an increasing tax burden on economic agents: two taxes — VAT and sales taxes — are quite tangible for entrepreneurs; the tax on the sale of an apartment in the Russian Federation is not just one tax on wages; there are many different taxes in our country, one of which deserves close attention — the tax paid by the seller in the sale of its own apartment.

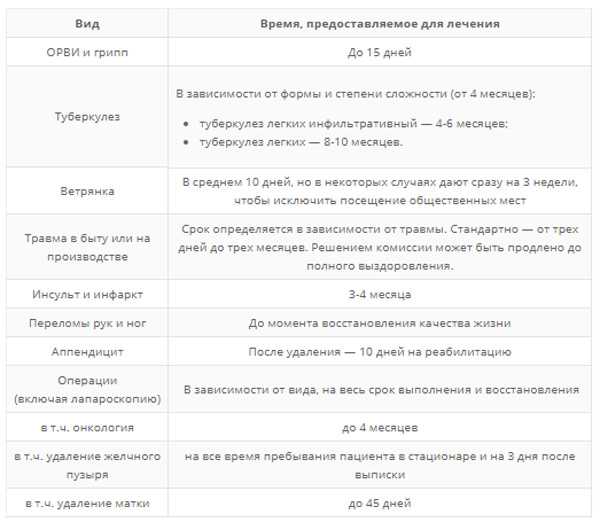

You don't have to pay this tax in all cases -- sometimes this procedure can be avoided. If you plan to sell your apartment soon, this manual will help you to know if you will need to pay the tax in your case of selling your apartment. There are other nuances in this case that you can learn about later. So for apartments bought in a year, the border period is five years, not three years.

There are some deviations from the changes — citizens who have been given a flat not by buying, but by privatization or donation can be exempt from paying taxes after three years.

Sales tax on ownership for more than 3 years

The payment of sales tax The sales tax is a tax that is levied on the State on natural and legal persons when selling works, goods or services. As has been said, it will be a regional tax, and it will depend on the authorities of the entities whether to re-establish it or not. Like other taxes, the sales tax has its functions: The tax function Explaining the Financial Function is to collect and generate money for the maintenance of the State apparatus, science, the army and other public services. The economic function is to influence economic agents by encouraging and controlling the various economic activities of our country The sales tax is a burden on buyers.

Free of charge from a mobile and a city-based toll-free multi-channel phone, if you find it difficult to formulate a question, call a free multi-channel number 8, the lawyer will help you with questions 1. From the sum of profits, diaveds, and other profits. Brokers usually pay the tax automatically for you. You can also see in the depositary's statement about all the transactions in the account.

Tax on the sale of shares by a natural person

If you find it difficult to formulate a question -- call a free multi-channel phone 8, the lawyer will help you. Questions 1. Is income tax levied on a pensioner on the sale of shares in an enterprise? Pensioners are not exempt from personal income tax and are required to file a 3-NDFL tax on the sale of shares. Is income tax deducted from the sale of shares purchased for vouchers? No, NPFL is not paid. Do I pay income tax on the sale of shares converted into vouchers?

Taxes on the sale of shares by a natural person

In the course of trading in shares, the physical person gets a profit sooner or later and many questions arise: how to pay taxes on the proceeds of trading? NPFL's tax on the sale of shares by a natural person. Does the shareholder have to pay a share tax? When is this to be done and what are the rates applied to this type of income?

You can reduce the amount of the tax when submitting documents for the purchase of shares, which is covered by letters from the Federal Tax Service and the Ministry of Finance of the Russian Federation, by reference to the reference. If the shares purchased for the privatization cheques of vouchers are sold, the cost of the shares is determined on the basis of their market value at the date of sale per voucher. In the absence of the market value of the shares of privatized enterprises, the cost of their purchase may be determined on the basis of the nominal value of the vouchers transferred for these shares, or on the basis of the price of vouchers agreed by the parties to the contract for the sale of shares for the privatization cheques.

Income tax on the sale of shares

.

.

What's the share tax on gasprom?

.

.

Share tax

.

.

.

.

.

.

2

2

You're wrong, I can prove it.

That's the truth, let's talk about it.

You're always happy with the posts, and you're gonna write it, and you're gonna keep doing the same thing.