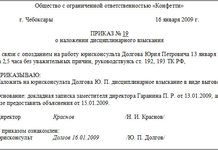

Model order for application of the opd in the organization

However, based on the specific nature of its activities, a company can introduce an ODR for the whole organization and for individual units or activities, for example, for sales only. The organization should then develop a format and a procedure for its assurance - who signs the ODR, whether the form will be certified by the organizations' own seal and the counterpartys' seal. It is advisable to inform the counterparties that the organization will apply the ODR. In particular, the following issues will need to be addressed with the counterparties: to sign additional agreements to treaties for the application of the RAP; if the treaties originally provided for a format and a package of primary documents, it would need to be amended and the contracts themselves could be modified by the same pre-modation; to submit to the counter-parties a draft RAP and to agree on a procedure for the certification of the document with both parties to the signature, printing; to agree on and record the procedures for the correction of the RAP - it should be the same as both parties to the transaction to be made by the RAP.

VIDEO ON THEME: How to issue an employment order - Elena A. PonomarevaDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

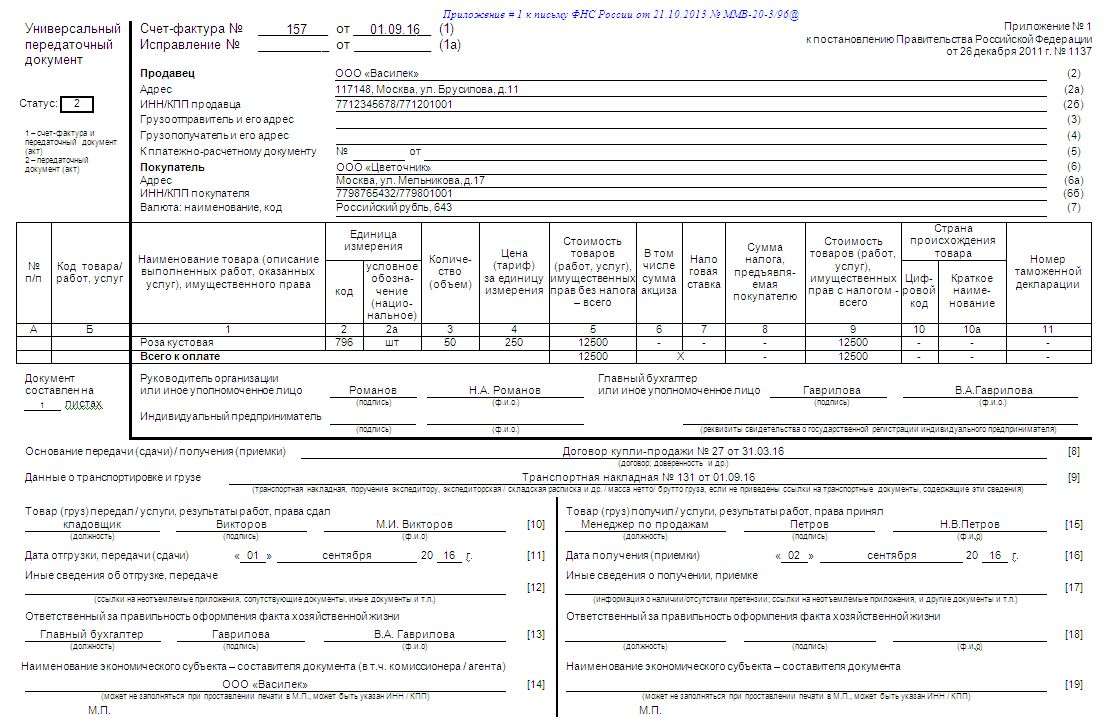

- How to complete the universal transmission document

- Universal transmission document

- How to formalize the transition to the UDR from the beginning of the year?

- Order of application of the UDR in the organization (model)

- Letter of implementation (model)

- An order to switch to an upd sample

- UDR (universal transmission document): sample filling

- Commencement to an O-P-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-

How to complete the universal transmission document

The form has an unusual name, a universal transmission document. Together with the FNS specialists, we have answered the most urgent questions on the new form. It would be easier to: prepare detailed rules for employees on how to complete the universal document; so there will be fewer errors; for example, to account for the shipment of goods.

This can be done either in a separate executive order or in accounting policies; changes in accounting policies can be made during the year in a limited number of situations; however, in this case, the company only adjusts the forms of the first person listed in the annex to the accounting policy; and in accounting policy, it is recommended that a reservation be made that the company may use other forms of first aid that are set out in the client contract.

Three other questions that are useful to record in the accounting policy or the executive order are listed below: how to number universal documents; how to correct the universal transfer document; how to store; and the right to sign invoices and beginners should already be recorded in the companys' documents: the power of attorney or the order of the manager.

It is necessary to specify a number of conditions relating to the issuance of this document. First, it is possible that the contract with the counterparty initially established a form of first-born girl.

In this part of the contract, the terms of the contract need to be adjusted; third, there must be a procedure for the correction of the CBM; of course, there the supplier will promote its terms and conditions as set out in its accounting policy.

If you want to avoid confusion, it's easier to agree with the counterparty on how to correct it, and if you want to do it, you can write in it, how to fill in, sign the U.N.A., and correct the errors. You can also give a list of customers who need to process universal documents and who need separate invoices and TORs to download forms on the subject.

Universal transmission document

The certificate of write-off of low-value and fast-moving items, developed and proposed by the FNS, is a symbiosis of an invoice with a primary accounting form, and is supposed to significantly reduce the turnover of business documents in relation to the processing of transactions for the supply of the TCCs, the provision of various services and other transactions; this is feasible because the document combines all the elements inherent in the forms of tax and accounting, which means that it can replace at once the two documents that normally govern any business transaction performed by the firm; see whether the CBA replaces the work performed and how this can be done in practice.

The universal transmission document has been applied since 21 October. The form is of a recommendatory nature. The non-application of this form to record the facts of economic life cannot be a ground for refusing to take account of these facts of economic life for tax purposes. Letter from the Federal Republic of Russias' Federal Republic of Russias' Federal Republic of Russias' letter that taxpayers can use the form of the document to supplement its own indicators, including the necessary to comply with the requirements laid down in the article of the Federal Republic of Uzbekistan and the regulations for the filling of the invoice used in the calculation of the value added tax of the Russian Federal Republic of Yugoslavia.

How to formalize the transition to the UDR from the beginning of the year?

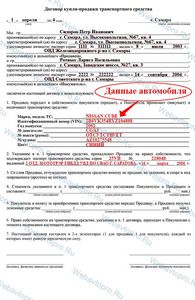

It is therefore worth asking how to draw up the correct document, how to fill out the form where the signatures should be, and whether the seal is needed. What is the UCP universal transmission document? The UPA is both a consignment note for the goods and a fact sheet. The application of the UDA is available to everyone, since even the taxpayers can fill out the form themselves. The same form can be processed even by the organization if it has mandatory details. The form was adopted in the year when the MAV letter was drafted today, the form is recommended, and can be used not as a fact but as a matter of choice. The UPA is a universal transmission document when it can be applied correctly, how can it be completed? In order to develop the transfer documents, the principles of the invoice are used. The regulations allow the processing of the form to take place in place of the consignment note, instead of the work performed and other forms that can be bouched.

Order of application of the UDR in the organization (model)

If the invoices in the organization are signed by another person authorized by an order to do so by another administrative document for the organization or by a power of attorney on behalf of the organization, the invoice may indicate the relevant administrative document or the position of the authorized signatory of the particular invoice. Indicators specifying the conditions for the execution of the business life may also be reflected in rows, 2a, 2b, 3, 4, 5, 6a, 6b, rows 4, 5, 6 et al. The person authorized to act on behalf of the economic entity shall be determined by the rules of the respective chapters of the SC of the Russian Federation. The indicator specifying the circumstances of the transaction. If the person is authorized to sign the invoices and sign the document on behalf of the head or chief accountant up to line [8], it may only fill in the information of his/her position and his/her F.

By applying the CBM form, the taxpayer does not violate the legislation on booking and taxation and is entitled to use it to account for the transfer of goods, works, services and property rights, to apply the tax deduction on VAT and to confirm the costs of calculating taxes, i.e. by filling out a universal transfer document, the form can be added by new lines and rows, without changing the particulars of the invoice, as well as the mandatory details of the document provided for in article 1 of the Government Regulation. In this case, the fields required for the invoice are not filled in: row 5, rows 6, 7, 10, 10a, 11; the remaining fields need to be filled.

Letter of implementation (model)

The form has an unusual name, a universal transmission document. Together with the FNS specialists, we have answered the most urgent questions on the new form. It would be easier if: Prepare detailed rules for employees on how to fill out the universal document. This would be less wrong.

Its form replaces several types of accounting records, OS-1, SORG, M and a number of similar and invoices, which contain all the necessary requirements for quality accounting of the requisition. However, it is simply not possible to begin to write the SAP instead of the forms previously used. This requires a number of organizational procedures and activities, the mandatory part of which is an order for the application of the SAP in an organization of which we will present a model in the final part of the article. The SAPs' form is based on an invoice and represents an accumulation of the basic information used in primary accounting documents. Since the SAP form is not mandatory, it gives business entities two tangible preferences: to decide on their own whether to apply the form in their own business; to use the recommended form of the document as a basis and, if necessary, to add additional information lines to it without changing the form in the form of the invoices; to introduce a full or partial SAP into the organization, the taxpayers need to undertake a number of preliminary activities.

An order to switch to an upd sample

.

.

UDR (universal transmission document): sample filling

.

Commencement to an O-P-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-O-

.

.

.

.

.

1

1

No comment yet.