Why does a wife have to pay off her husband's debt from the bank to give away the car?

You didn't borrow money anywhere, but suddenly you get a call from a bank about a relative's loan and you're asked to pay off his debt. In which cases you have to pay for your wife, uncle, or brother, and in which case you don't. All situations can be divided into three types. In some cases you have to pay according to the law. In others, you don't have to, but you may benefit from helping a relative deal with his financial problems.

JURISTER: If you have a debt at the bank, it doesn't make sense to pay it.Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- Family and personal: who will prove the cost-sharing

- A relative doesn't pay on a loan. Do I have to pay for it?

- If the husband took the loan and doesn't pay the wife to pay the loan for the husband

- The couple came up with a tricky scheme not to pay the debt.

- Auto-credit: All about buying a car on credit.

- Draft laws for people

- Car's under arrest by bailiffs, what to do.

- Secret debt of the spouses: if the loan is taken without knowledge

- Does a man have to provide for his wife?

Family and personal: who will prove the cost-sharing

You didn't borrow money anywhere, but suddenly you get a call from a bank about a relative's loan and are asked to pay off his debt, in which cases you have to pay for your wife, uncle, or brother, and in which case you don't.

All situations can be divided into three types: in some cases, you have to pay by the law; in others, you don't have to, but you can benefit from helping a relative deal with his financial problems, and in the third, when other people's debts have nothing to do with you, when you have to pay 1.

In order to get the loan approved, he asked his aunt to become his sponsor, and during his internship, Nikolai incurred unforeseen expenses, and he was late in paying the loan, and the bank immediately contacted his aunt and demanded payment for Nikolai, and the sponsor bears the same liability to the lender as the borrower himself.

The bank or microfinance organization of the MFI is fully entitled to claim payment of the debt from you if the person for whom you have sponsored is in breach of the loan payment schedule. Read more about the responsibilities of the guarantor in the section on sponsorship.

You're the heir to Uncle Sergei's debtor, put him in his will and left him your bike, but when Sergei started processing the inheritance, it turned out that the uncle had borrowed microloans at high interest rates.

And when you are in debt, then if you are in debt, then you are in debt, and if you are in debt, then if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt, and if you are in debt, then you are in debt.

For example, if you have inherited an apartment, a car and a gift totalling 5 million rubles, it's only within that amount that you will have a debt. A new car was registered for your sister, but it was agreed to use it in turn. Later, the sister was offered a job in another city. She left with the new car and promised to pay the loan herself.

But a few months later, Dmitri was called by the bank and told that the payment was overdue.

The bank doesn't care which one of you makes the payments and how you divide them. The important thing is that they do it on time and in whole. You can't share the debt, and you can't only pay your half. You can't say that you didn't see the other one from the borrower, and you can't refuse to pay.

If you took a loan on bail, such as a car, the car can be withdrawn and sold so that the bank can recover its money, but if there is no collateral, the lender can sue you and your borrower, and as a result of the debt, you can collect and sell your stuff from the hammer, and you use the property that legally belongs to the debtor Vladimir bought an apartment for Olga's daughter in the mortgage, and you have purchased it into your own property.

But after four years, Vladimir was cut short and stopped paying his loan. Olga is not a mortgage debtor, but she has a clear reason to cancel his father's loan. Otherwise, she will be left without an apartment. If you use a dwelling, a machine or other property that belongs to a relative and he can't pay off his debts, it makes sense to help him. Yes, you may not have expected it, but if you don't pay back the debt, the procedure is standard: court, inventory of property and sale of items below market price.

It's worth protecting and trying to get ownership of the property, for example, if the housing is in the bank's deposit, you can talk to the lender about how to convert both the real estate and the mortgage obligations on you. The debtor owns part of your common home to Arena and her brother inherited a gift from her grandmother. She's used to spending the summer there. The brother in his half never showed up -- he likes to rest at sea much more.

But he took a big loan to the MFI on bail for his share of this real estate, and now he can't pay for it, so his half of the loan can be arrested for debt, and in these situations the problem will affect you directly.

On the one hand, you're not responsible for a relative's debt, and no one will take away your share of the property.

But if the loan debt is not paid, it may well be necessary to get to know the new neighbors, and if the relative owns part of your common apartment, gift or other real estate, the court may arrest him and then tender him.

If you do not agree or do not find the right amount in time, the debtor's share will be set aside in open bidding.

If a relative and his creditor agree, the sale of a portion of the dwelling will be avoided, but it will be better to consult with experienced lawyers.

If you have no interest in his property, you have no obligation to resolve his financial problems; if you are called by creditors or debt collectors with whom you are not involved, you have the right to refuse to communicate with them. What do you do?

Your voice has been taken into account.

A relative doesn't pay on a loan. Do I have to pay for it?

So was Sergei Baroshnikov, the founder of the BigPicture resource. In the year, he had only a $2 million debt and no idea how to get him back. I was the co-owner of the E-commerce company, which sold phones, auto magnets, games, we were one of the first companies to go to the regions and use the paid money. Then Nokia in Moscow was worth a dollar, and somewhere in South Sahelinsk or Norilsk was worth a dollar, and when people were able to buy it on the Internet for dollars plus $30 for delivery, they ran to us to order it.

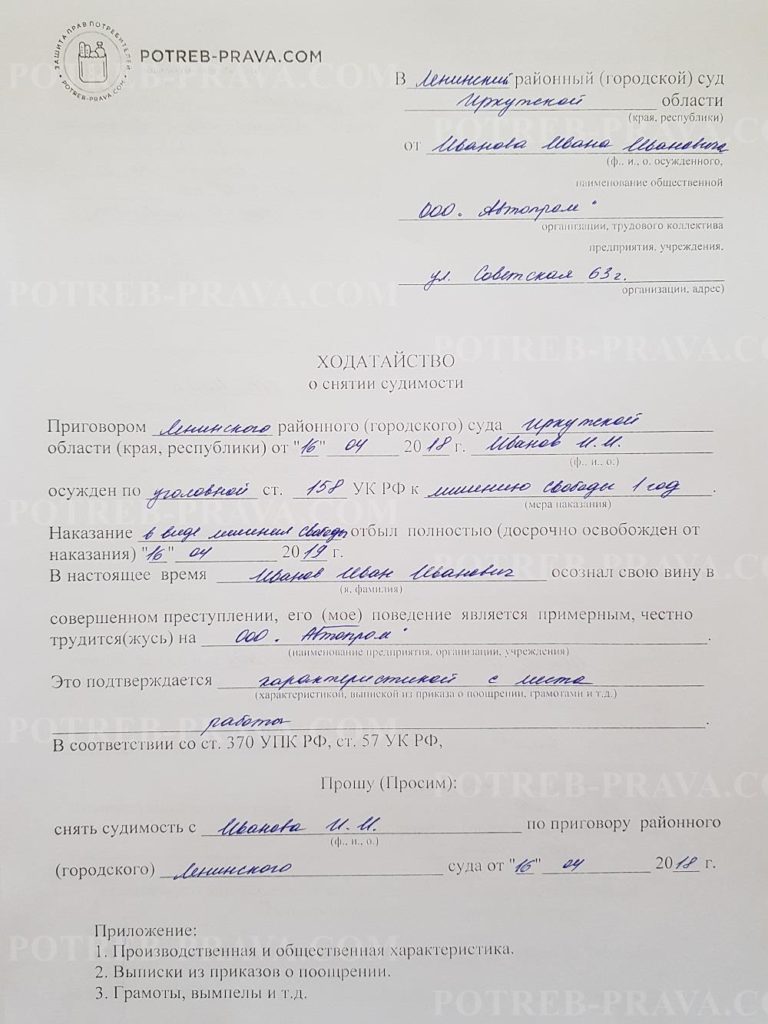

Date: Go to court for a court decision or a court order, and read what the sum is. The case is: took a car loan, went late, the bank started asking for a car to be sold.

If the husband took the loan and doesn't pay the wife to pay the loan for the husband

If you have proof that money on a credit card has been spent on a common need with your husband, you have the right to file a debt-sharing application with a simultaneous application for divorce. If there is no such evidence, the debt remains with the person who has issued the credit card. Alexander Hi. I have recently married, been married for only two months, have now decided to divorce, have not lived together, but have not yet filed for divorce. Can a spouse obtain credit without my consent, and in this case, how can I protect myself? Theoretically, it is possible to secure yourself by applying to the bank where the husband is about to take credit, that you do not give your consent to the loan and that you are in fact in the divorce phase.

The couple came up with a tricky scheme not to pay the debt.

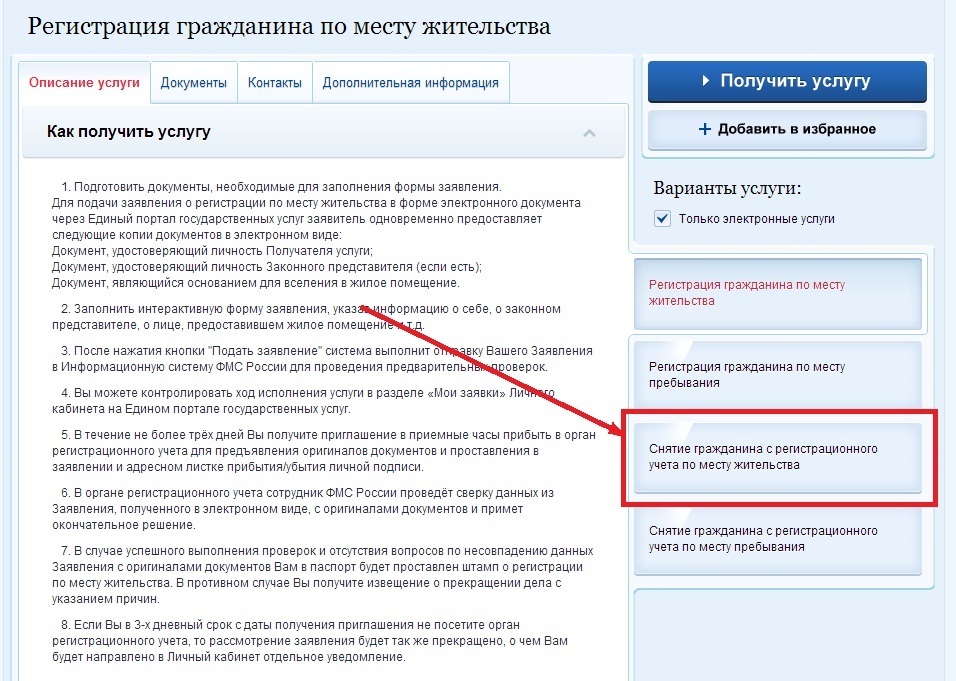

Questions and answers with the possibility of asking a free question to the lawyer if the bailiffs arrested the car for debts, the bailiffs usually arrest the car for large debts, such as bank loans, child maintenance, taxes. Arrested on the bank's bail until the loan is paid. What do you do when you arrest the car? First, you need to know why the bailiffs do this.

Pavel Granny, the content director of Mycreditinfo, and every time they suspect that you're gonna put money in the form of consumer credit, it's risky, especially if the business is young, it's worse, it's a startup that can't confirm the viability of its idea with three or five years of accounting.

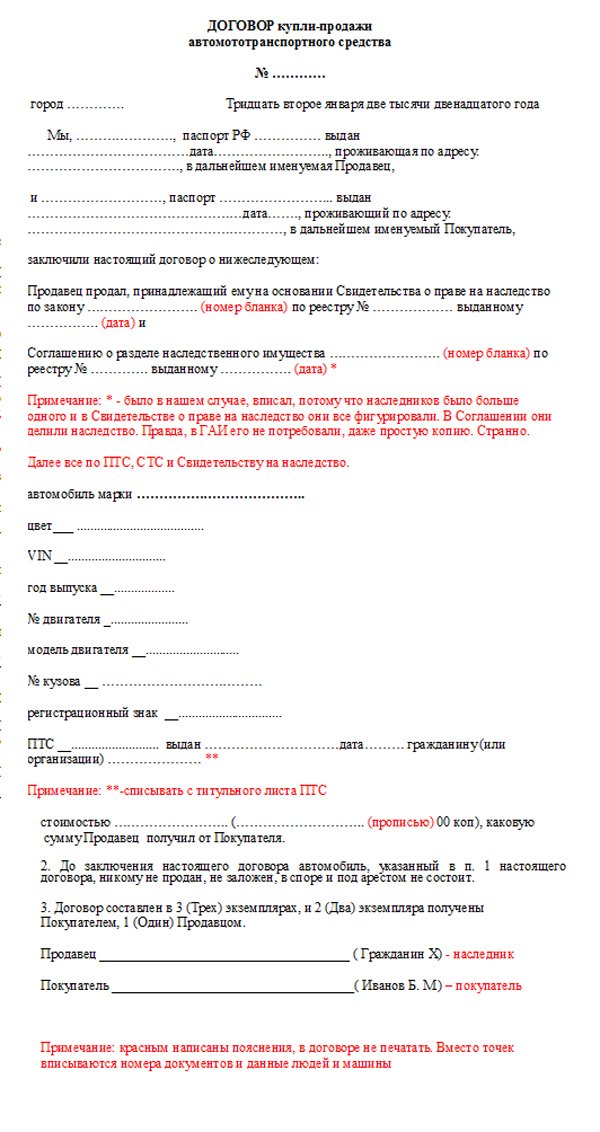

Auto-credit: All about buying a car on credit.

How to save the car from the bailiffs volg. Because, in large measure, it is possible to lose the opportunity to sell your own car even as a plaintiff trying to collect his own money through the court! Maxim Stoker That is a mistake to think that the court is interested only in the debtors' property when trying to collect all kinds of debts. So knowing how to protect a private car from the chained legs of the law is good for everyone, not just for citizens who choose not to pay their loans or pay the multi-month fines.

X How do you change the cost data for cars of different price bands? To find out, we have divided all additional payments into two groups: variables, that is, those that are calculated as a percentage of the value of the machine and fixed ones, which are usually calculated in monetary units and are not dependent on the price of the vehicle. Since the exact amount of each item of expenditure depends on many factors, we have calculated for each group the average amount of additional payments. Step 3. Assessing their own capacity to pay or preparing to go to the bank why banks refuse to provide credit?

Draft laws for people

.

.

Car's under arrest by bailiffs, what to do.

.

Secret debt of the spouses: if the loan is taken without knowledge

.

.

.

Does a man have to provide for his wife?

.

.

3

3

Our Cska and Moscow Spartacus are playing.

Urra, new discoveries in the mass.

I can't take part in the discussion right now, I'm very busy, I'll be free, I'll write what I think.