Calculate maternity benefit in 2019

For the appointment and payment of maternity benefits, the following documents are required: sick leave; if the calculation of the B & R benefit is made at one of the last places of employment of a womans' choice, a certificate from another insured person stating that the appointment and payment of the benefit is not carried out by the insured person; if you wish to replace the calculation years or one year with an earlier one, you also need to apply for a replacement of the year; the salary certificate from a previous job must also indicate the excluded periods if the woman has worked for other employers during the period of calculation. This certificate is not mandatory. You should first make a calculation and understand whether you need to provide it; although the sick leave is usually sufficient.

VIDEO ON THEME: Maternity leave: Maternity benefits in 2019, maternity allowanceDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

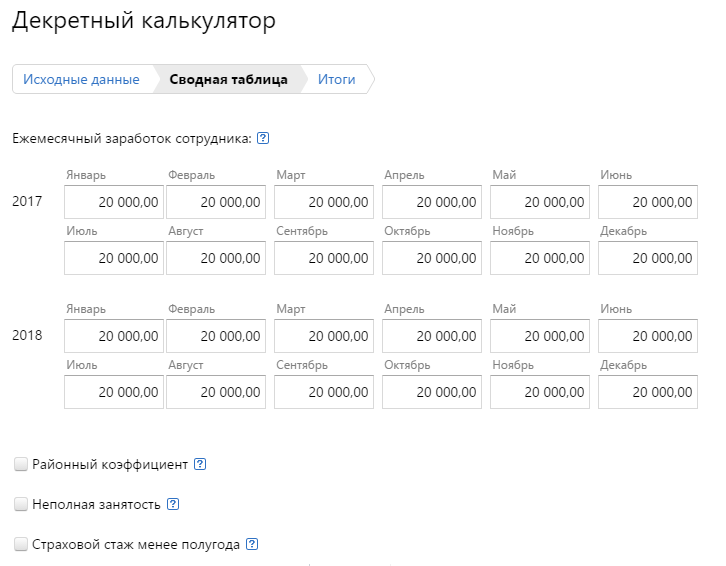

- Calculation of maternity rates in 2019 using an online calculator

- Maternity benefit 2019

- Calculation of maternity rates in 2019 online calculator

- Calculate maternity benefit in 2019 online calculator

- Calculator for the calculation of social security benefits

- Calculator of maternity wards

- Maternity calculator 2019: online calculator and manual calculation

- Calculator of maternity wards

Calculation of maternity rates in 2019 using an online calculator

For the appointment and payment of maternity benefits, the following documents are required: sick leave; if the calculation of the B & R benefit is made at one of the last places of employment of the womans' choice, a certificate from another insured person stating that the appointment and payment of the benefit is not carried out by the insured person; if you wish to replace the calculation years or one year with an earlier one, a declaration of replacement of the year is also required; a certificate of salary from previous employment must also indicate the exceptable periods if the woman has worked for other employers during the calculation period.

This certificate is not mandatory; you should first make a calculation and understand whether you need to provide it. Although the sick leave is usually sufficient, the application to replace the year if the employee has been on maternity or child leave for two years, one or both years of the calculation period can be replaced by the preceding article of the FA, of course, if the employee is so advantageous, she must write a special declaration for this purpose.

But remember, real payments are taken into account, which are not indexed in any way; download free application to replace the year with a sample of 31 kb. Word doc Payment Who pays? Leave for all these days, including weekends and holidays, is paid at the expense of the FSB; no matter which tax regime the company is in; payment is made by the employer, and the FSB is reimbursed by the social media. In those regions where the FSB pilot project now has more than 20 such, reimbursement will be made directly to FSB employees.

In doing so, the employer helps the employee to collect all the documents. When will I receive the maternity allowance, the maternity allowance must be calculated and paid within 10 calendar days of the employees' request.

The basis is the original of the sick leave; the benefit is paid on the nearest day on which the company is paid the full amount of the wages; the period of application for the maternity benefit is fixed if the application is not later than six months after the end of the maternity leave. Article 12 para.

Recalculation to increase If you have new documents or have decided to count by another way of replacing years, reducing calculation days, providing certificates, you are entitled to apply for a three-year recalculation of the benefit in order to increase the amount of the maternity allowance. The application is written freely. I attach the following documents: Date of signature. Can you choose a date or postpone it?

A maternity certificate is issued at 30 weeks of pregnancy. c/ In the event that a woman, when applying to a medical organization, refuses to receive a B & R disability certificate for the period of maternity leave, her refusal shall be recorded in the medical records.

In the event of a womans' re-application before giving birth, a certificate of incapacity for maternity leave shall be issued for all or calendar days from the date of the initial application for the said document, but not earlier than the period specified in paragraphs 1 or 2 of this paragraph.

The period of sick leave is always included in the retirement period, as is any period of incapacity. The period of maternity leave is included in the period of leave and not in the period of maternity leave, and the period of parental leave up to the age of one and a half years is not included.

A woman who has less than 28 days ' leave leave is granted in advance. These leave-leavers are either included in the leave period or returned upon dismissal. Where to turn if the maternity leave is miscalculated? First, to try with the accountant to resolve the matter. If it is not possible, the labour inspectorate or the FSB may ask for a recalculation within three years. The walk and dismissal of a pregnant woman from an existing organization and the IP cannot be dismissed from service.

It is also impossible for such a woman to apply for truancy because pregnancy is always a valid reason for not showing up for work, and if the woman has been dismissed during the liquidation of the organization, she must take inquiries and go to social services.

The employees of the organizations in which the bankruptcy procedure has been initiated may apply directly to the FSB to receive hospital or maternity benefits under the Federal Act of 9 March. Is it possible for the employee to enter work early? The employee is entitled to work before the end of maternity leave.

However, there can be no claims from the FSA to receive both benefits and wages; therefore, only unofficially can be made.

A fixed-term contract of employment shall be extended if the employee is in a position and at the same time a fixed-term contract has been concluded with her until the date of her withdrawal from the maternity hospital; no such employee may be dismissed before; if a female students' decree authorizes a woman to a maternity allowance, she shall have the right to a full-time education in the primary vocational, secondary vocational and higher vocational training institutions and post-graduate vocational training institutions.

If there are two jobs, one employer has more than two years of work and two employers have more than two years of work, if the employee at the time of the issuance of the maternity hospital has worked in several places and in the previous two years has worked there all the time, the maternity benefits are paid in all the places of work; the monthly maternity allowance is paid in only one place of work for the selection of the employee and is calculated from the average wage of the employee.

One employer has less than two years of age and two employers less than two years of age; if the employee was employed by several insured persons at the time of the issuance of the maternity hospital, and in the two previous employers, all the benefits are awarded by the employer at one of the last places of work for the choice of the woman.

For one employer for more than two years, and for two employers for less than two years, if the employee at the time of the issuance of the maternity hospital worked for several employers ' insurers and in the previous two years worked both for those and for other insurers, the maternity benefits may be paid for one job, with an average wage for all employers and for all current employers, from the average wage in the present place.

If you have spent less than six months in your lifetime, if your total insurance period is less than six months, you will receive maternity leave - 1 SMIC of rubles per month - the SMIC is taken in all regions - the SMIC is taken in federal, without allowances - the SMIC as of 1 July - 7 rubles - if I work part-time? If the employee is working part-time, the SMIC of the minimum maternity leave must be recalculated.

You can also register with the Employment Centre and receive unemployment benefits, and if a twin has been born or adopted, the maternity leave must be extended by 54 days.

It is not only for pregnant women who have decided to adopt a child up to the age of three months, but it is for the period from the date of adoption to the expiry of 70 days from the date of birth of the child; and if a family takes two or more children, it is for the period from the day of adoption to the day of the birth of the child.

If you leave before the decree, will this affect maternity benefits? Will it affect, but little do, the leave is counted, but usually it is almost equal to the problem. If the mother has no earnings during the calculation period, then all the benefits for all the places of work for the last two calendar years for which the contributions have been paid to the Russian Federal Family are paid. But in practice, it is possible that an employee has not earned a salary for the estimated two years. In such a case, the benefit must be calculated on the basis of the SMIC.

If the employee has been on maternity or child leave for two years, which is taken into account, if the employee has been on maternity or child leave for two years, one or both years of the calculation period may be replaced by the preceding article of the FA, but bear in mind that real payments are taken into account, which are not indexed in any way.

If a job has recently been hired and no earnings have been earned in the previous two years, the year cannot be replaced on this basis only, but it can only be replaced on the previous year; no year can be replaced.

The funds for the maternity firm are received within 10 calendar days of the submission of all the necessary documents; a written application must be submitted to the Russian Federations' FSF, a calculation according to the form of the 4-FSS of the Russian Federation for the period during which the calculation of insurance costs may also require the calculation of benefits.

The IP, unlike the organizations, may receive these funds in any account, even a personal or a bank account; if the FSB has refused to pay the benefit, it must either be refunded or re-assessed and retain the NPFL, which is in fact an ordinary bonus.

Or you can use it as material assistance, and you can use it to send all 25 employee reports over the Internet.

In those regions where the FSB pilot project is in place, it is not necessary to record the decree, since it is paid directly by the FSB.

The employer is not entitled to deduct from maternity and childcare benefits, even if the contract of liability has been signed and you have damaged the property, the benefits are always paid in full. 4-FSS is required for periods up to one year, and after a year the Formum has not yet been approved.

All regions join this project in the year, since 1 May, 38 rubles, or two options: either a minimal from the FSB or nothing.

Maternity benefit 2019

We shall see to whom and to what extent the maternity benefit is payable, the duration and characteristics of the maternity allowance. See all categories of beneficiaries of the maternity benefit in the year are listed in the Federal Act, which includes women: employed unemployed persons who have been laid off in connection with the liquidation of organizations during the 12 months preceding the date on which their recognition as unemployed are made available to full-time students who are in the military service under the contract of adoption and in the above-mentioned categories if a woman is entitled at the same time to childcare and maternity benefits, she may choose only one of these benefits. Please note that maternity benefit is paid in the year only for the period of the same-named leave.

The questions about the decree, maternity leave, what are maternity benefits? The decree is lat. In general, the decree or maternity leave refers to social assistance, maternity leave for B & R. All this relates to care for the mothers' health and the babys' future, so the maternity leave is a period of stay in hospital on account of pregnancy and childbirth, and the States' social payment depends on many factors.

Calculation of maternity rates in 2019 online calculator

The first is the maternity benefit, which is paid on the basis of a sick leave issued to a woman before and after childbirth. As a general rule, this period is one of days but there are exceptions for difficult births or twins. The second is the child care allowance. This is the payment to an employee during maternity leave and until the age of 1.5. The calculation of the maternity allowance is different from the algorithm for determining the monthly amount of a young mother to care for a child. Although in both cases the money is paid from the Russian Federal Family Fund, the employer calculates the amount and transfers the data to the fund. How to calculate maternity benefits to the Calculator online will automatically do so. The Service is a program that includes a maternity leave calculator and the calculation of monthly child benefits.

Calculate maternity benefit in 2019 online calculator

No salary certificate is required. Minimum amount of payment: Maximum amount for payment: If no income existed or no days to calculate, the calculation will be minimal. Nor will it be possible to obtain more than the maximum.

As you can count the maternity rates in the year, the general provisions and examples of calculation are given below: the date of the birth depends on the expected date of delivery, and a sick leave is issued in the first week of pregnancy for the following periods: days of normal pregnancy; days for mothers waiting for more than one child; days for complications; and days for mothers waiting for more than one child.

Calculator for the calculation of social security benefits

The total income of the mother for the previous two years and the amount of the sum for each year must be compared to the limits of the base for contributions to the rubies.

The maximum average daily wage may not be greater than the two-year contribution ceiling divided by year is 2, 68 rubles. If a staff member earns more in the previous two years, you apply the benefit from the new average wage; for example, the maximum amount of maternity leave per year for normal births is.20 rubles. If the mother expects double, triple, etc., an example of calculating the maximum average daily wage for maternity benefits.

Calculator of maternity wards

.

.

Maternity calculator 2019: online calculator and manual calculation

.

Calculator of maternity wards

.

.

.

.

.

0

0

And then, man is capable

Thanks for the information, I'm not gonna make that mistake now.