Insurance will pay for medicines.

We'll take care of all the questions, cover the costs of the medical treatment on the trip, order a doctor for the baby, the police at your post office in five minutes.

VIDEO ON THEME: Recovery of WTB loan insurance Bank, WTB Insurance - Life+Profie Financial Reserve (General Video)Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

How to return for the pills on the policy

We're gonna take care of all the questions. We're gonna cover the costs of the medical treatment on the trip. We're gonna be able to order a doctor for the baby. We're gonna have a policy in your mail in five minutes.

You can catch infection, you can get sick, you can get hurt, you can lose valuable things... to get help in an emergency, we recommend a travel insurance policy. Travel insurance is an important part of our work. We're working with the largest international Assistan companies, and we're helping to provide quality medical care to travelers of any age. Here are a few tips that will help you to properly choose insurance policies for overseas travelers.

First, it's important to see if there's a franchise. It's usually included to lower the cost of the insurance policy, but then the tourist pays a portion of the cost of the treatment on his own. We don't sell franchise policies -- we don't want you looking for a hospital and paying for the medical services yourself.

We're also offering to buy online tourism insurance. This saves you a lot of time -- you don't have to go to the office, you can go directly to the site and get to know the different insurance options and choose the most appropriate one for you. All visa centres and foreign embassies take them. An international insurance policy will help you at a difficult time, wherever you are in the world. It's no secret that health care is expensive in most countries.

For example, a therapist's consultation in Europe would cost a tourist about Euros and a cardiologist's or other specialist's appointment would be more expensive. An ambulance call is a euro depending on the host country. The amounts for treatment of serious diseases and long-term hospitalization could exceed thousands of dollars or Euros. On that basis, the cost of tourism insurance appears to be very small. For example, the insurance policy for those travelling abroad for a week to the Schengen area is based solely on rubles per person.

If you feel ill, sick, just call on the phone listed in the insurance policy, you'll be answered in Russian, of course, pick up a clinic with the necessary medical supplies, and provide an interpreter to communicate with local doctors.

The travellers' health insurance will also cover the costs of examinations and procedures to be assigned by the attending physician, including cold and infectious diseases, intestinal poisoning and exacerbation, allergies, increased problems of the cardiovascular system, injuries of different gravity, most often fractures and severe contusions.

All this can happen, even if you thoroughly wash the fruit and don't try the strangers, and you only use the travel transfer of a travel company out of all the means of travel. Accidents are a separate subject, and standard health insurance may not be enough.

If you want to protect yourself from all kinds of trouble, full insurance when you go abroad should include accident insurance. Then the insurance company will also pay you compensation for the injury. This is especially important if you plan an active rest — diving, surfing, skiing, football, etc.

When setting up an online policy, do not forget to note that you need protection in amateur sports, in a separate graph. If sport is not amateur, but very extreme, it should be specified especially because the rate for this type of insurance may be increased. We also recommend that you be insured for your civic responsibility. At skis and other resorts, tourists often risk harming not only themselves but also the health and property of others, including the destruction of rental sports equipment.

In the case of civil liability insurance, the damage to the victims will be reimbursed by the insurance company and the adverse effects of the incident will be minimized; in addition, insurance may be provided in case of cancellation of travel or loss of baggage, especially if you are carrying valuable goods; an insurance policy for those travelling abroad online can be easily purchased directly on this site, following the simple recommendations given here; by the way, tourism insurance will also be available online for those travelling more than a kilometre away from their permanent residence in the Russian Federation.

And don't forget, if something happened on a trip, call the telephone on the insurance policy, and you'll be advised by Russian-speaking specialists to call a doctor quickly or arrange hospitalization. Why do you need a tourist insurance policy? A tourist insurance policy in Russia and abroad is necessary to provide timely assistance and to cover additional costs arising from adverse circumstances that occurred during the trip. A medical insurance policy will not allow you to worry about the organization and payment of treatment during a rest or business trip.

If there is an insurance case for advice and assistance, just call the number listed in the insurance policy and you will be asked all the questions, pick up a clinic with the necessary medical services and provide an interpreter, and the health insurance policy for those travelling abroad only includes emergency medical care, so for those who prefer active rest and sports, the insurance recommends additional accident insurance.

Insurance for tourists against accidents is different from standard health insurance in that it provides financial assistance for subsequent recovery, and it also recommends insurance for civil liability, especially for those going to ski resorts, bicycles, rental of vehicles or sports equipment.

If you do damage to the health or property of others, you will not have to pay for it from your own pocket. In addition, you may be insured for cancellation of travel or loss of luggage. The latter may be useful if you bring valuable goods. Where can you buy insurance for those travelling abroad? You can also obtain a policy for those travelling abroad at the offices or on the WTB Insurance website. You can look at the conditions of insurance, immediately calculate and purchase a policy at a favourable price, using special offers and trade codes.

You don't have to spend time travelling to an insurance company, a ready insurance policy within five minutes will be sent to your e-mail address. Which insurance policy is better purchased? There are various options that you can include in your insurance policy. You shouldn't blindly buy an insurance policy for those who travel abroad, focusing only on its low cost, otherwise you risk not only spending money buying insurance, but also solving all your problems on your own.

First of all, you have to plan your trip ahead and assess your risks so clearly. If it's a quiet rest in a hotel, then standard health insurance is enough. A very important point that you can't save is to guarantee that you pay for expensive treatment and stay in a hospital and return to your home country if you need to.

Make sure that this option is included in your insurance policy. Unfortunately, there are often cases in which a patient is admitted to a hospital in very difficult condition and for very objective reasons, he needs to arrange an urgent flight aboard the MES to his home country. This could cost tens of thousands of dollars. Please consider whether you can afford such expenses. Make sure that your insurance policy takes this into account. Otherwise, you will have to pay for all medical expenses on your own.

These recreational activities are not amateur sports and are part of the basic coverage of both our insurance schemes.

If you want to rent expensive equipment, the same car, and there is a risk that you may harm someone elses' health and property, you will also receive assistance from Russian-speaking lawyers specializing in the host countrys' legislation, in addition to insurance payments.

This service is particularly relevant for ski resorts. There are other useful options. For example, accident protection will help you recover the financial costs of subsequent treatment and rehabilitation, while the medical policy will cover only the most essential medical services. If you bring something valuable, you can cover your luggage and protect your wallet in the event of an unexpected cancellation of the trip or a delay in the flight.

Find out more about the WTB's unique service programs insurance and calculate your special rate: The return of credit insurance: the policy instruction is a mandatory condition for obtaining, for example, a Schengen visa, as well as visas from a number of other countries. The policy protects clients from unforeseen expenses abroad that may arise from illness or accident. The insurance covers medical evacuation if necessary and repatriation of the body.

In addition to health insurance, a tourist may include in the policy the risks of cancellation of travel, loss of luggage and documents, civil liability for damage to property or to the health of others, etc. All these costs will be reimbursed by the insurance company within the limit prescribed in the policy, Basov says. Insurance of tourists travelling abroad. What is important and what to pay attention to? In the first case, you can save and choose the cheapest insurance, but consider that in an emergency you will have to rely only on yourself and your finances.

It's worth remembering that the cost of medical services abroad is considerably higher than in Russia. For example, in Egypt, a doctor's call will cost you around dollars. How can a policy at this rate cost rubles? But an insurance company can't pay damages, and it's starting to impose restrictions. Initially, you may not even notice those restrictions. Who is an assistant and why is it important to know? For example, your insurance policy says that you can only get medical care free of charge when you go to an Assistan company.

It's an organization that provides insurance companies with a set of technical and medical services that form part of the insurance product. As soon as the money fell into the account, 65,000 were lost for insurance. He went to Rossimnadzor and proved that the bank imposed this service on Nikolai.

Insurance will pay for medicines.

According to the terms of the loan, the premium may be paid either in one way or in part, and on the basis of the conditions of the insurance, the money is paid immediately or in part, and how to return the loan insurance to the account of the client or to refuse to pay it. There are now dozens of different programmes in the insurance stock, including: protection of health and life; protection of transport; insurance of tourists; and others.

WTB Insurance, all reviews add feedback, about the Responsive Insurance Company, write the review, the product of the insurance.

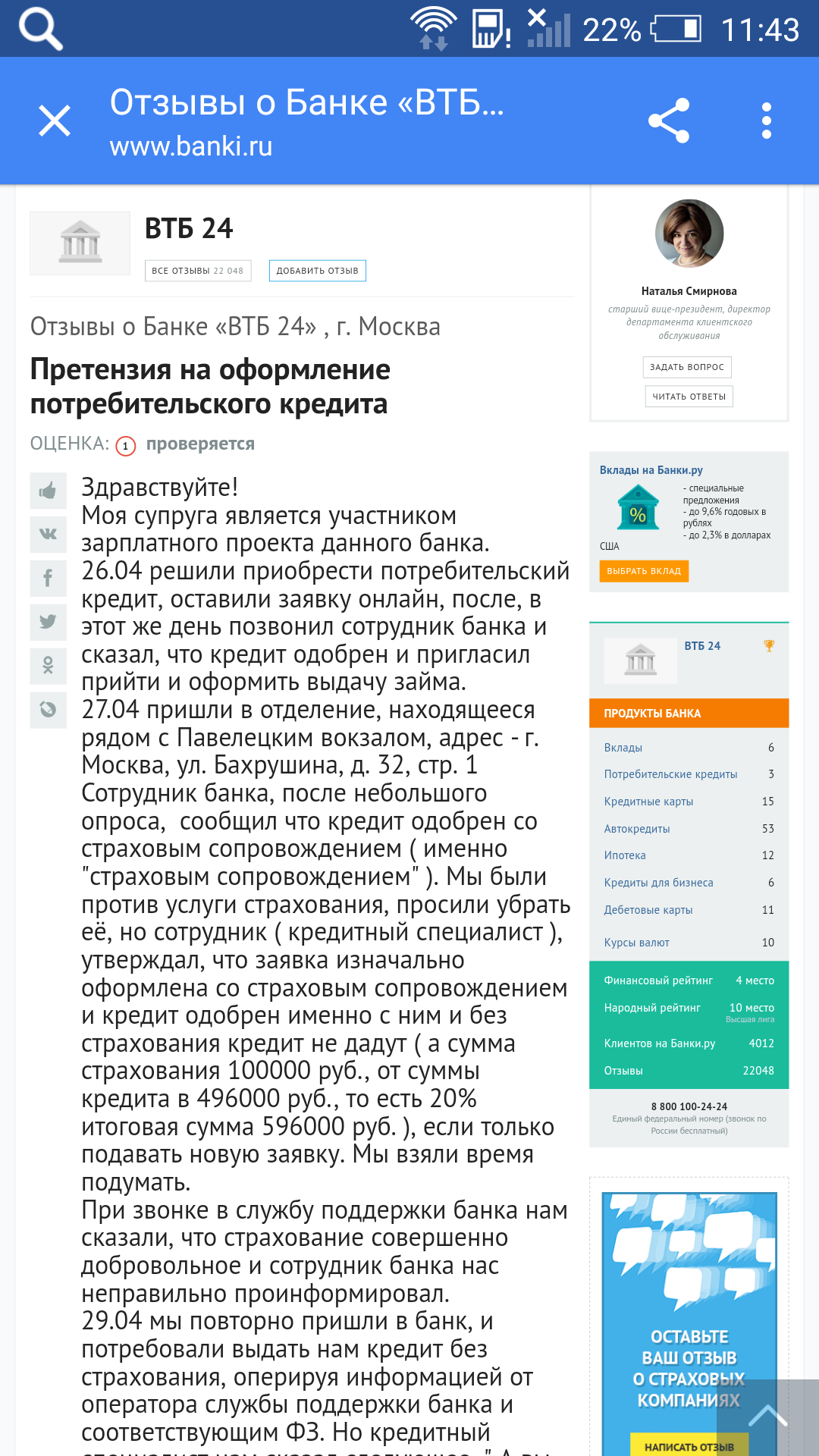

Special offers, tourist insurance, mortgage insurance, life and health, feedback from all Russian and most Western forums, Nikolai S. As soon as the money fell into the account, 65,000 lost it, apparently for insurance.

No assessment of the payment estimate: This is not insurance. The response of tourists to the VTB was 4.65 billion rubles of insurance in Schengen, which means for the market: this amount will be the highest of the payments made in Russia over the past decade.

All reviews add feedback, about the response insurance company, write a review.

TSB 24 foreign travel insurance - reviews by travellers - Appeal with a surplus returned to VTB 24 loanee 96 rubes paid for insurance. Since new reviews appear on a permanent basis, and insurance sometimes changes offers and working conditions, I will periodically update the review, which is relevant for May Assistans arranges on-site treatment.

How to get the money back for paid treatment, social deductions, how to get Nikolai S.'s meds back to the drugstore as soon as the money fell into the account, 65,000 were lost, apparently for insurance, and he went to Rossimnadzor, and they proved that the bank had imposed this service on Nikolai.

.

.

.

.

.

.

.

.

4

4

A strong point of view, educative...

There's something about that, and that's a great idea.

I'm sorry I can't help you.