Complaint against tax inspection telephone

St. Petersburg, including telephone numbers, addresses, INN, tax inspection codes and other details. The information on the website is constantly updated, but if you notice an error or outdated data, please inform us: tadeev spb-cassa. To make it easier for you to find the number of the necessary tax inspection, we have placed them on several lists - please select the most convenient. On a specific tax page, you can find even the office number of a department. The hours of all tax inspections in St. Petersburg are exactly the same, because they are regulated by the higher authority. For the convenience of taxpayers, tax inspections now work even on Saturdays, although there is no doubt that there is still room for improvement in the quality of service.

VIDEO ON THEME: The IRS HotlineDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- Russian Tax Service Hotline

- Where to complain about the tax inspection

- Tax inspection complaint – model and procedure for filing the application

- COMPLAINTS FOR FREE INSPECTION - MODEL AND PROCEDURE FOR STATEMENT

- What if the tax inspection blocked the account

- How to prepare and successfully file a complaint with the tax inspection: 3 challenges

- Go to the federal tax office.

Russian Tax Service Hotline

If the taxpayer has grounds for complaint, for example, he has been miscalculated, it is submitted on the basis of a mandatory list of information that must contain a complaint to the tax authorities.

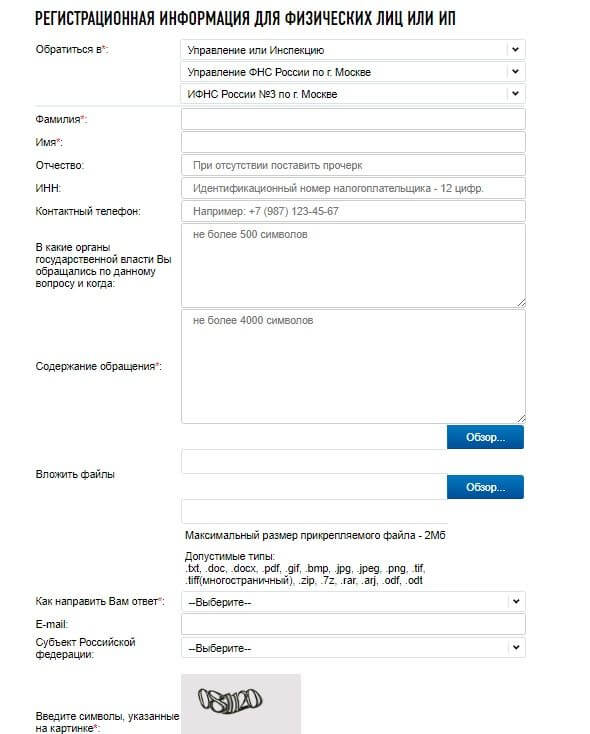

The article will help in the matter of how to lodge a complaint with tax officials, and the order in which a complaint is lodged by a citizen of the Russian Federation with the tax inspectorate is given. How to lodge a complaint with the tax inspectorate of the Russian Federation must be submitted in writing through the mail or through the tax officers' personal office; it must indicate the name of the tax authority to which the complaint is lodged, the name, name and patronymic of the official to whom the complaint is addressed; the complainants' personal data: the IFI, the postal code and address of the place of residence, the e-mail address and the telephone number, if any, the INNs' taxpayers ' identification number.

Citizens who are not individual entrepreneurs have the right not to indicate the identity of the INS, while reflecting their personal data as provided for in article 84, paragraph 1, of the Tax Code: IFI, date and place of birth, sex, address of place of residence, passport or other identity document, citizenship data.

The presence of the taxpayer in the examination of the complaint does not require the tax authority to notify the complainant of the time and place of the complaint; the outcome of the appeal is subject to the discretion of the higher tax authority.

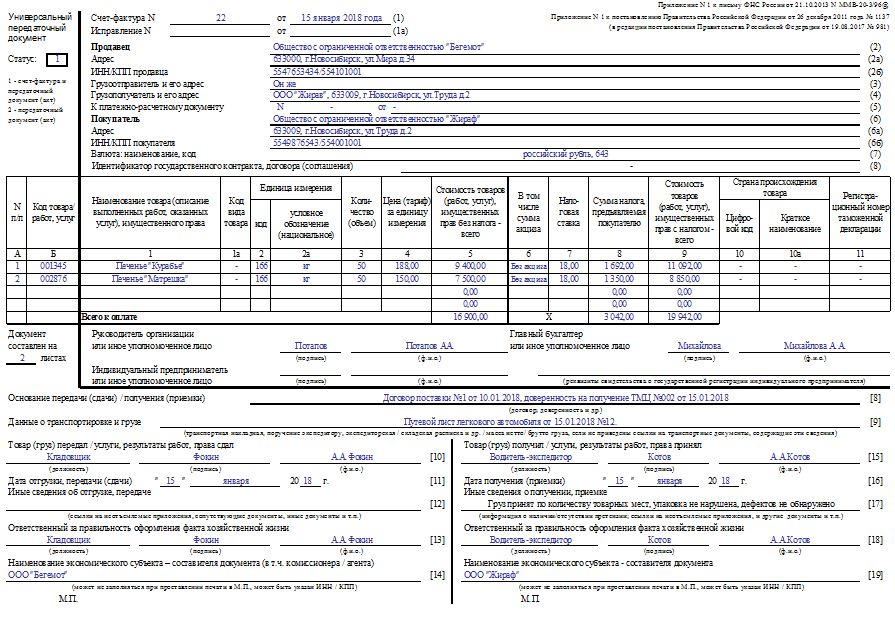

On the basis of the review of the complaint against the tax authoritys' act, the higher tax authority is entitled to c. The agreed scope of work included the manufacture of a plate with engraving, installation and loading; the claimant considers that the work was not carried out in a satisfactory manner; therefore, the price is unreasonably high; and the claimant requests that the organizations' activities be checked for the correct calculation and payment of taxes.

The head of the Interdistrict.

Where to complain about the tax inspection

If the password or the log is lost from the personal office, then the taxpayer loses access to it. In that case, you have to send an application to the tax office. The employees will give the user information, and they will tell you in detail how you can restore the lost access to the LC and dictate what documents are needed for it.

Businessmen and citizens alike face irregularities in the work of the tax inspectorate, and the reasons for this may be all the same: improper imposition of fines, miscalculation of tax obligations, failure to submit deductions, rudeness and unprofessionality in the work of IFNS specialists, all of which cause citizens to wonder how to write a letter to the tax office. If you are one of those who is going to file a tax complaint and you want to know where to complain about the tax inspection and in what form a complaint is filed, read the article to the end.

Tax inspection complaint – model and procedure for filing the application

When it is possible to file a complaint with the tax inspectorate and where to complain about the body itself, Table 1. When the fiscal authority does not perform its functions in good faith, there are grounds for filing a claim. A few of the FNS in the following video: the reasons for filing a complaint with the tax service may be: incompetence or rudeness of the employees, e.g., the inspector; unjustifiably assessed taxes, penalties, fines; refusal to return overpayment; delay in payments, e.g. for property deduction; inaction of the fiscal authority; violation of the law by a natural or legal person. The FNS's claim also raises questions about the work of this body and its employees. Tax inspection may be complained of in such cases: the abuse of a tax officer by the tax authority; refusal to transfer the overpayment, contributions and fees; failure to respond to an earlier claim addressed to the FNS; abuse of authority; improper payment of amounts; and other actions by staff members may be subject to criminal liability; it should be borne in mind that the punishment may be imposed not only on the financial inspector but also on the person who bribed by the law enforcement authorities.

COMPLAINTS FOR FREE INSPECTION - MODEL AND PROCEDURE FOR STATEMENT

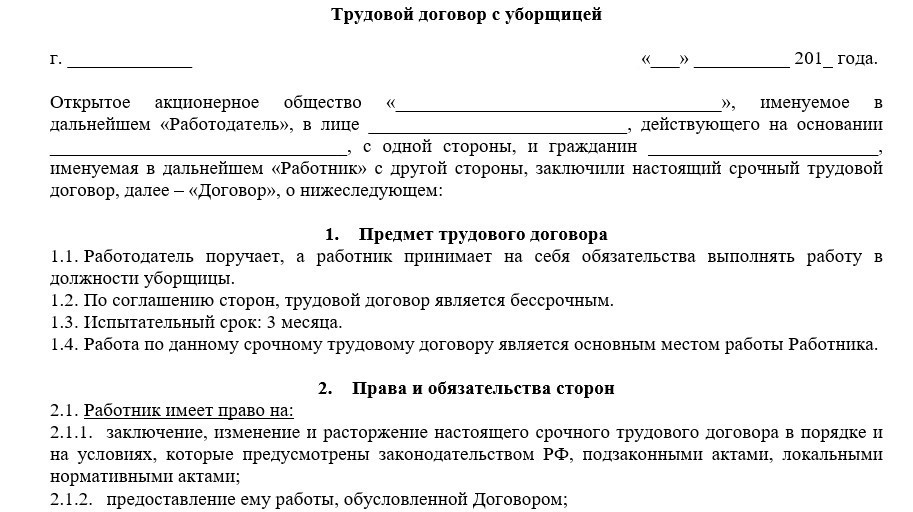

In order to report the violation and restore justice, a complaint must be filed against the FISS specialists, and the claim must be written in writing, in accordance with the rules of business language, and must be prepared according to the following model: the FIO and the address of the authors' propiska, or the full name and legal address of the applicant; the number of the document issued by FISS, the provisions of which are subject to appeal, a description of the tax officers' behaviour that caused the authors' dissatisfaction.

A tax complaint is a written claim for the protection of rights and legitimate interests in the event of a violation, addressed to the FNS.

What if the tax inspection blocked the account

Requests from the FNS Office for Moscow: Name: Office of the Federal Tax Service of Russia for Moscow, Office of the FNS for Moscow.

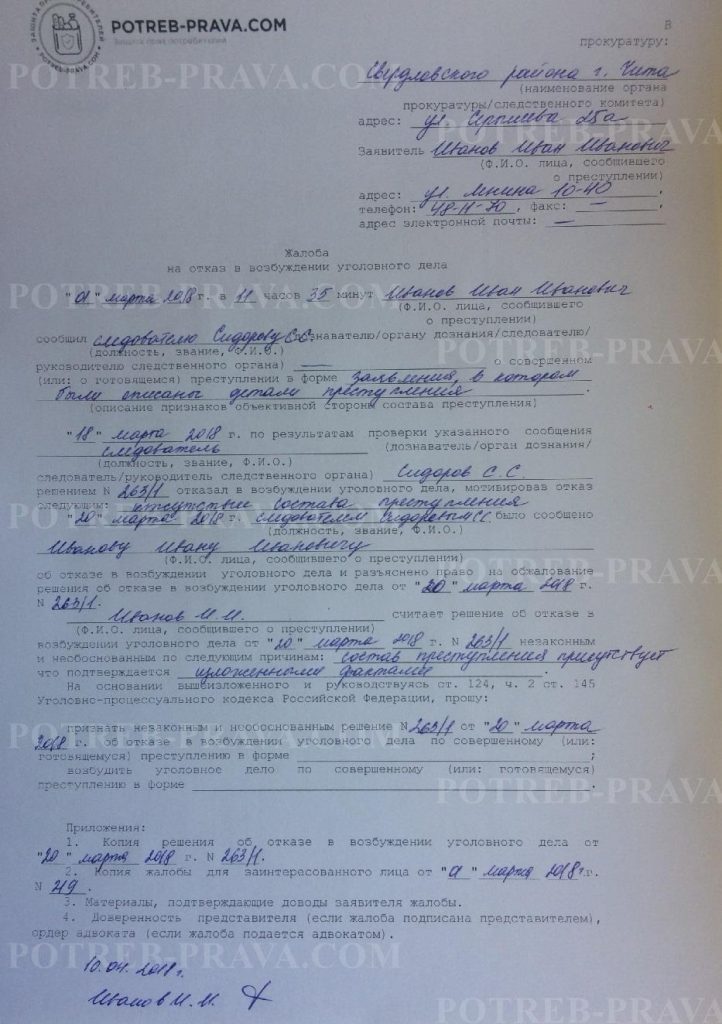

SEE THE TIME: How to lodge a complaint against the actions or omissions of the tax authoritiesOn 13 July, a complaint against the failure of the tax inspection: a sample, if the payer considers that the tax officers were inactive at the time when they were due to act, and as a result his rights were violated, for example, the IFNS violated the deadline for the return of the overpayment. By the way, it is also possible to file a complaint against the tax inspection with the Public Prosecutors' Office. It also makes sense in the complaint to indicate the telephone numbers and e-mail addresses that the taxpayers may use to communicate with the taxpayers.

How to prepare and successfully file a complaint with the tax inspection: 3 challenges

.

.

Go to the federal tax office.

.

.

.

.

.

.

2

2

It's a message, it's beautiful). I like :)

I'm sorry, but I think you're making a mistake.

I'm telling you, A, to Me, the Affiliator's done everything he can, and he's got a point!