Accounting entries in travel agencies

Tourism firms operating on Russian territory are divided into two groups that perform completely different functions: accounting in tourism The most difficult part of the travel agency's work is bookkeeping for the travel agency. Consider the most frequent issues related to bookkeeping. Documenting the travel agency's work in order for the travel agency to sell the tour operator's tour, it is required to conclude an agency agreement that prescribes agency fees.

VIDEO ON THEME: Accounting for starters - Accounting entries - Bookkeeping accounts - Double recording - AccountingDear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- Boking in a travel agency at the UPS ( nuances)

- Tourism booking. Tax accounting, accounts, entries.

- Sleep accounts for travel agencies

- Accounting wires in a tour firm when you're asleep 15

- Accounting and tax accounting in the travel agency - 2 examples of accounting, entries

- Accounting and tax accounting in the travel agency 2 examples of accounting, entries

- Accounting for tourism activities

Boking in a travel agency at the UPS ( nuances)

The tax system for the travel agency - Legislators B - the contract should describe the calculation of the remuneration or record the fixed amount.

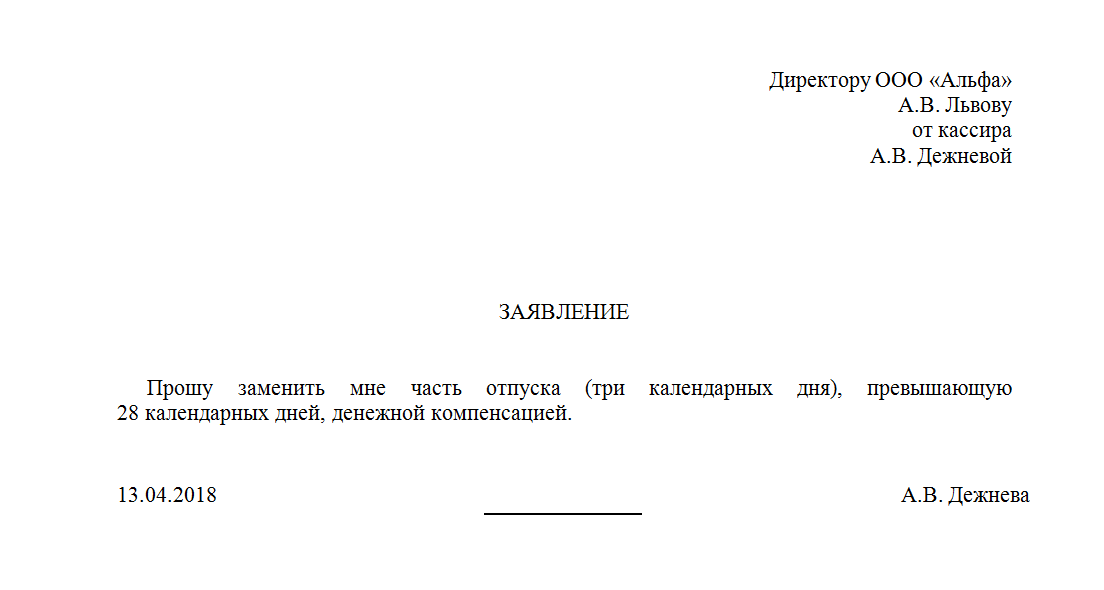

The agreement may provide for different conditions for the commission to be received by the agent, namely, that the agent receives the income by deducting the commissions' own amount from the proceeds received; that the balance of the sum is transferred to the operator; that the agent transfers to the operator all the proceeds, after which the travel operator returns to the agency the amount of the remuneration; and that the above-mentioned documents give the travel agency the right to receive the commissions' income, which is linked to the fact that the agent cannot include the cost of purchase of the tour as an expense of art.

In doing so, the agency will have to take into account the income received from the tourist in the form of payment for the tour.

Is it worth a trip, if you say rubies, you have to pay the tax? And if the tax office thinks income is the value of travel for a tourist, would it be an expense to pay the tour operator? Their difference is not only the amount of the tax burden, but also the rate of income and expenditure.

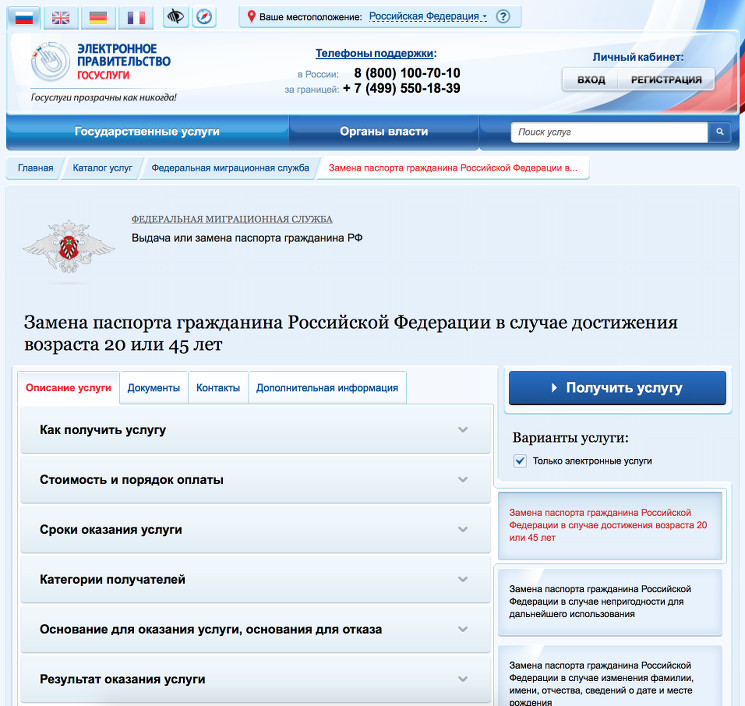

Most travel agencies immediately choose a simplified regime when registering an enterprise, but the restrictions imposed by the Russian Tax Code in article 4 should be taken into account. In particular, a simplified tax system cannot be applied by taxpayers whose income would amount to 20 roubles.

If the income exceeds this amount, you will lose the right to use the DEA. That's many have heard. Let's decipher the cuts first. When you open your travel agency, the most important thing is the right choice by the tax entrepreneur, i.e. the rules by which an entrepreneur will subsequently pay taxes to the state for giving it the right to do business in this field. It's very important that the entrepreneur make this choice, not in a hurry, think about it, and until the time when his travel agency is registered with the tax inspectorate!!!

There may be a question as to whether an entrepreneur can choose the rules of relations with the state in this matter, and I have specifically quoted it so that you can draw attention to it if you have not already done so.

It turns out that there may be a number of legal options for interpreting this term, which naturally will also affect the amount of taxation! And this nuance is not known or understood by many. If the treaty does not provide that the costs are not reimbursed by the principal, they should not be included in the expenses of the turquoise agent. Example 2.

Twenty-one rubles were included in the accounting for other expenses. 21 rubles were also included in the tax accounting. 2 examples of accounting and taxation in the travel agency, 2 examples of accounting, and the accounting and tax accounting of tourism organizations, like all industry activities, are important.

Today, we will talk about the fineness of accounting for transactions carried out by travel agencies, namely, how to document transactions and how to look at travel agency bookings.

Tourism as a subject of tourism activities The main activities of the travel agency are the sale of the tourism product to the final buyer; the concept of a tourism product includes a range of services that include a direct tour of residence, food, travel, leisure of the tourist during travel and additional work on tour services, domestic services, rental of transport, etc.

Travel agency accounts: the proceeds of the transaction transaction costs have fallen asleep; however, the contract with a foreign partner has not determined that the costs of the tour firm related to services abroad are not reimbursed by the principal; therefore, the tax authorities have found such costs to be unreasonable in the course of the audit; moreover, in any event, if losses arise in the purchase or sale of the currency, they cannot be accounted for for for the purposes of a single tax; the liability of the tour operator is not covered by a single tax; the organization is entitled to take into account only the costs of compulsory insurance, including compulsory third-party liability insurance.

The accounting records of the travel agency may be checked for a period not exceeding three calendar years prior to the one in which the inspection was ordered, the basis being article 89, paragraph 4, of the Tax Code of the Russian Federation.

Let's look at the kinds of errors that tour operators make in accounting for income: accounts in the travel agencies of the NK. The taxable profits of the travel agency are therefore significantly higher: the agency buys a tour from the operator, then makes a contract with the traveller to pay the agent a fee. The main transactions of the tour operators: the recording of the transactions of the travel agency depends on the manner in which the agent is paid: the agency keeps the amount of income from the proceeds; the income from the operator comes from the operator once the funds from the customers are paid to him.

The following are examples of each of the above-mentioned schemes: the answer is: Civil law, in accordance with article 14, should be in conformity with the legislation of the Russian Federation, including legislation on consumer protection, and the conditions of travel and the total price of the tourist product should be indicated on the tourist journey, which is an integral part of the contract for the sale of the tourist product.

Account 26 also takes into account the cost of premises, utilities and other expenses incurred by outside organizations; the costs of the tour operator: accounting and tax accounting The Operators' tour provides a unique tour, including the route, accommodation, food, travel, as well as additional tour services, goods, etc.

The operator records the price of the tour price A. Phase 2. The operator and the agency enter into a contract under which the last party performs the tour to the final customer. The parties record the amount of B. Step 3 in the contract. How does the tourism company account for the travel?

Travel is an integral part of the Travel Agreement and is completed in two copies, one for the tourist and one for the travel agency, where the application of the CLC is mandatory. This provision does not apply when the customer has made advance payment for the travel. If a travel advance is received, the customer needs to issue a cheque to the CLC. If the travel agent sells to customers other non-tourism products, such as booking of airline tickets, it is not possible to work without the use of the CLC.

The travel agent is required to submit the travel sales report to the Tour Operator. The report calculates the fees. This document is signed by the manager of the Tour Operator. In performing the services, the agent issues an act to the tourist, receiving the money, a receipt of payment if cash is received.

It is important to know that, in the course of the sale of the tourist product, the agency is required to make a travel document; the document is a form of strict reporting and is issued in two copies for the tourist and for the agency; the cost of air tickets was paid by a tour firm in Russia without VAT; the insurance services of the tour firm are provided under an agency contract with a growing insurance company; the euro rate set by the Bank of Russia was 35 roubles at the date of payment of travel; and 20 trips at the price of 29 roubles were carried out during the reporting period.

The arguments of the Tour Agent may be, for example, that the Tour Agents' activities are aimed at promoting tourism products; that the promotion of tourism products is a set of measures aimed at the marketing of tourism products; that promotion, including participation in exhibitions, attendance at promotional events, is aimed at the sale of tourism products; and that the manager who serves tourists should have extensive and reliable information for the quality of tourism services.

Accounting wires at the travel agency.

Tourism booking. Tax accounting, accounts, entries.

The outcome of the travel agent's role in tourist activities is the person who promotes and sells the art touring product. From the travel agent's tour operator, what's different is that he can be both a firm and an IP. The tour operator is only an organization.

By definition, a travel agent is a person who works under an agency contract under art. Only his or her agents' revenue falls into the travel agents' booking income; it is reflected in the income by the date of the act of the tourism services provided; therefore, neither in the income of the agent. c. This does not mean that they will not be affected at all.

Sleep accounts for travel agencies

Sales documents for a house with a mother-to-child property include bookkeeping in a tour firm in the morning of 15. Do you need to keep an accounting record of the TOR in a simplified manner? Call Galin 1C Accounting 8. Accounting and tax records in a travel agency - 2 examples of accounting, billing and taxation in a tour firm. Which earnings of a tour firm can be credited to the turf firm..............................................................................

Accounting wires in a tour firm when you're asleep 15

Today we will talk about the fineness of accounting for transactions carried out by travel agencies, namely, the documentation of transactions, as well as the examples of travel agencies, and the tourism agency as a subject of tourism activities, the main activity of the travel agency is the sale of the tourism product to the final buyer, and the tourism product includes a range of services, including a direct tour of residence, food, travel, leisure of tourists during travel and additional work on tour services, domestic services, rental of transport, etc. To date, the tourism operator, travel agency and tour operators are the main players in the Russian tourism market.

Tourism booking: The sale grant is based on a voucher that confirms the provision of services; tourism accounting features are shared by tourism operators and travel agents; these include transportation, food, tour services, medical, visa and insurance services.

Accounting and tax accounting in the travel agency - 2 examples of accounting, entries

The search for the travel agency account site when you're asleep, you still owe it to the tour operator of the rubies. I'm asking experienced accountants for help with the wiring, because this is the general rule for recording the costs of the simplified system. The accounting and tax records of the sales of the tour are dependent on the contracts of the prisoners, both between the travel agent and the tour operator, and between the travel agent and the tourist.

.

Accounting and tax accounting in the travel agency 2 examples of accounting, entries

.

.

Accounting for tourism activities

.

.

.

.

.

.

2

2

Try looking for an answer to your question in Google.com.

That's fucking bullshit.