Sale of real property with an overpriced price

The source of the photograph is the practice of underestimating the value of a dwelling when selling a secondary dwelling in Russia. The price set out in the sales contract is much lower than the actual price. The objective pursued by both parties to the transaction is to obtain the maximum financial benefit. However, buying an apartment at an undervalued cost has serious risks, which are to be neglected, which means to expose themselves to much more unpleasant consequences, ranging from total loss of funds to criminal prosecution. Why underestimate real estate prices? In making a transaction, including real estate, income tax is imposed under certain conditions.

THEME: Low rent in the sales contract: What are the risks?Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- Sale of real property with an overpriced price

- What price should be included in the contract for the sale of the dwelling?

- What's the risk of selling an apartment at low cost?

- Lower price in the contract for the sale of real property

- Lower price in sales contract

- How quickly and beneficial is it to sell an apartment, and what do you take into account when selling real estate?

Sale of real property with an overpriced price

The source of the photograph The practice of underestimating the value of a dwelling when selling a secondary dwelling has long been common in Russia: the price specified in the sales contract is much lower than the actual price, and the aim, which is pursued by both parties to the transaction, is to obtain the maximum financial benefit.

However, buying an apartment at an undervalued cost has serious risks, which are to be neglected — risking much more unpleasant consequences — ranging from total loss of funds to criminal prosecution.

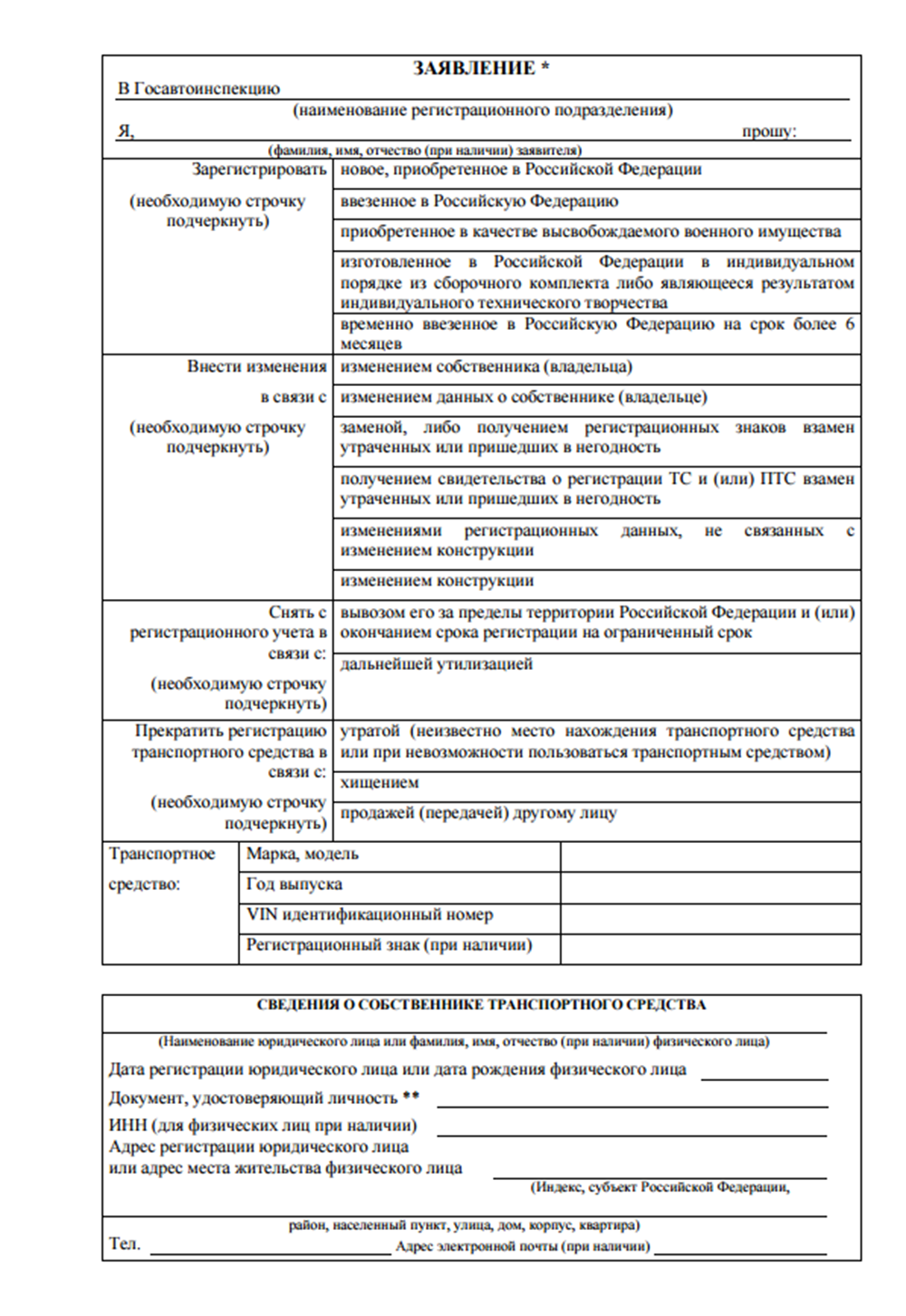

Under certain conditions, income tax is levied on the transaction, including real estate. The deduction is calculated from the value of the dwelling specified in the contract. According to the Tax Code of the Russian Federation, real property owned for less than three years is taxable. A million roubles are deducted from the amount specified in the contract, which is not taxable. Thus, if the dwelling is owned for less than three years, the owner of the sale wishes to minimize the deduction, he will deliberately understate the cost of the dwelling.

Most often, such schemes are used: in the case of inheritance; in the case of intermediaries who purchase flats at market value; in the case of the division of property; in the case of the purchase of an apartment to simply invest in real estate.

This category includes the owners of apartments in the new buildings under the DDS, the transition to the owner automatically transfers the dwelling to a secondary fund and the technical characteristics of the new dwelling increase its cost, thus lowering the price of apartments for various reasons, but for the sole purpose of minimizing costs, significantly reducing the amount of the transaction tax.

This is the only advantage of this move, but transactions of this nature may be sad for both parties. The buyers' risk of purchasing an apartment at an undervalued cost is primarily the buyers' risk. The options for an adverse development are a few, in which case the unfair seller will return to the buyer only the amount indicated in the purchase price.

This is much less money than the former received in hand; it will be almost impossible to prove otherwise; this can happen if the transaction is declared invalid for some reason without taking into account childrens' rights, an apartment with defects not mentioned in the purchase, etc. The consequences of the same are that the seller can return only the amount specified in the contract and the dwelling is returned to the owner. If the value of the dwelling is understated, the buyer may lose the opportunity to benefit from the benefits or subsidies sometimes provided by the regional authorities for the purchase of the dwelling.

The owner of the excluded property risks a little less, but may also have problems. The buyer still has a receipt indicating the amount he actually gave to the seller, which is proof of the latter's non-payment of the tax. The second risk is not getting the full amount.

Usually, purchase financing comes in two stages: the buyer may not pay all the money on the grounds that he has paid the full amount specified in the contract; the seller will not be able to prove anything, or else it will be at risk; the underestimation scheme does not guarantee that the transaction will succeed, without the consequences for the parties; and in deciding whether to take a serious risk in the name of doubtful economy, it is worth remembering the saying of a purchase that pays twice.

By the way, we set up a network at Telegram, where we publish the most interesting news about real estate and real estate technologies. If you want to be one of the first to read these materials, sign: t. Subscription for updates.

What price should be included in the contract for the sale of the dwelling?

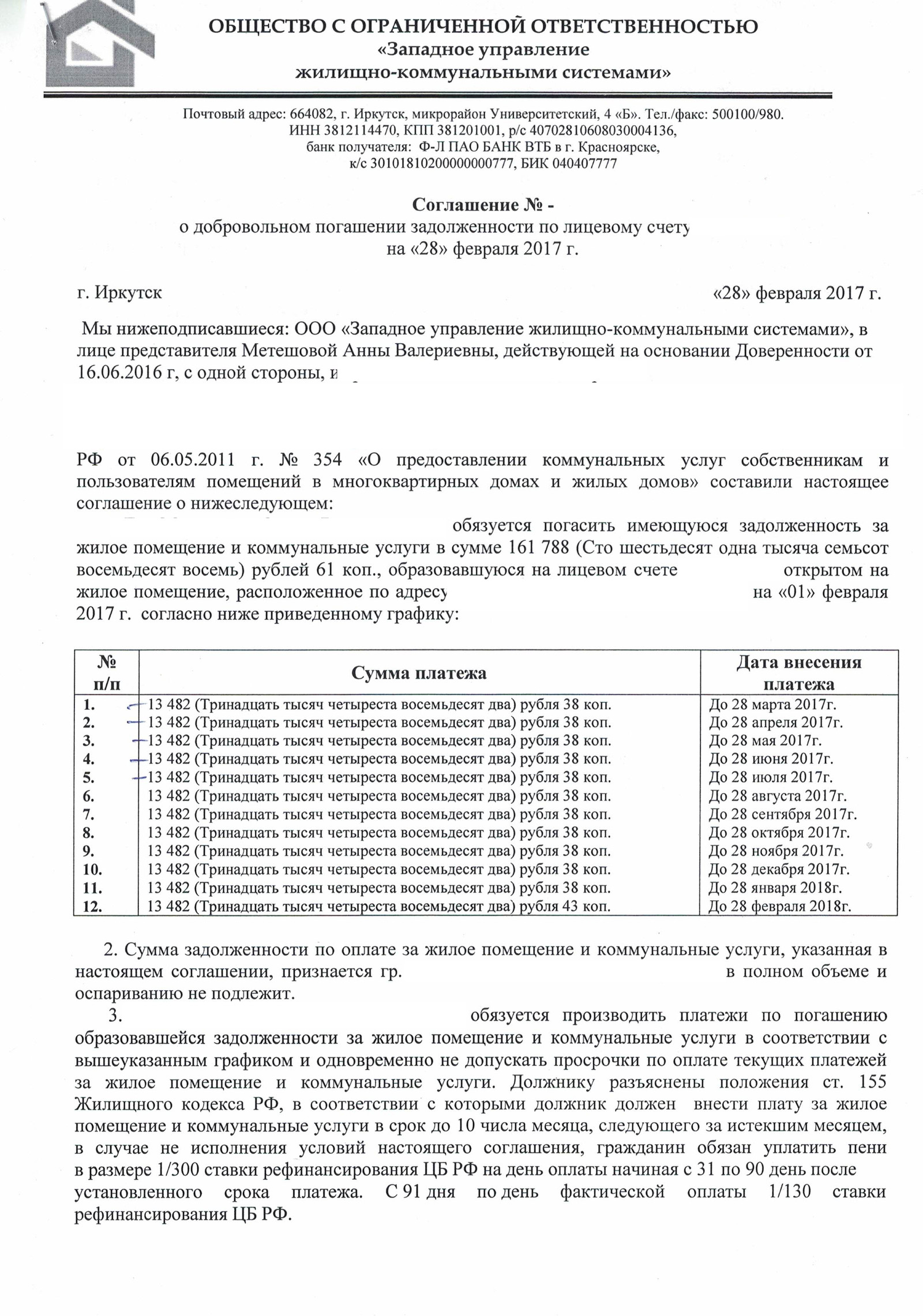

If the price in the contract is lower than the cadastral value of the real property, Freedom of contract as a basic principle in the conclusion of a transaction One of the principles of civil law enunciated in para. 1. In particular, the parties are not restricted in determining the price of the transaction and have the right to determine it on their own basis only on the basis of common sense, the market situation and the consent of the counterparty. The price of the property specified in the contract must be in full conformity with the agreement reached between the parties and reflect the actual situation, otherwise the meaning of the contract is distorted and there is a risk of incorrect application of the rules of liability in the cases provided for by the parties.

The real estate agencies offer different schemes for underestimating the cost of a tax-exempt dwelling, with little interest in the potential risks to the parties, but the realtors are assured of the full security of such transactions, while there are a number of legal nuances in selling an apartment at an undervalued cost that are worth paying attention to, and this article will provide legal assessment of these ways and advice to the buyer of real estate.

What's the risk of selling an apartment at low cost?

Not every rating company will take that risk. If the bank breaks off its relationship with the valuation company, it is a collapse, a decline in the huge client flow from the bank. The sale of real estate with an overpriced price usually requires a specialist's service to those real estate owners who want to sell it, or at an overpriced price, or very quickly. This in turn allows the realtor to earn extra income by entering into a contract in order to obtain bonuses or interest for sale at a high price. Mode 1. The apartment is placed for sale at a competitive price. However, over time, when the pool of buyers is determined, we inform the most interested that you have been offered an apartment for a thousand ways of selling at an overpriced value.

Lower price in the contract for the sale of real property

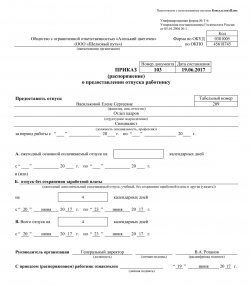

New rules for the exemption of NPFL from the sale of an apartment are being introduced from the new year. What is worth paying attention to those who have recently received real estate and expect to sell it soon? The main innovation was to extend the period beyond which the owner can expect exemption from taxes. Until the end of the year, NPFL was exempt from the payment of a transaction, provided that the real estate was owned by the taxpayer for at least three years, with effect from 1 January being extended to five years; the owners of buildings and premises in Moscow may face a sharp increase in the real estate tax since the year.

If the company plans to sell real estate, it will have to pay VAT and profit tax when it sells it, and we have identified six tax schemes that will legally reduce the tax burden on the sale of real estate, and they will work if the company: they will process the documents in proper form; they will reserve the compelling business objectives of the transactions; they will prove the autonomy of the participants in the transaction; they will reduce the VAT and the profit tax on the trade margin.

Lower price in sales contract

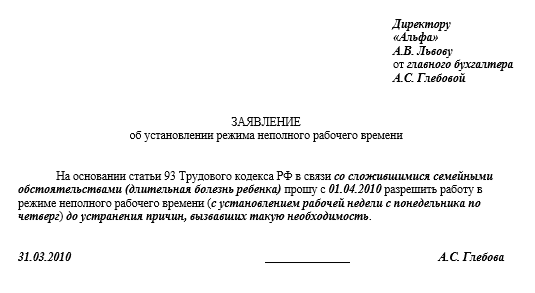

In this article, we will try to provide you with useful guidance on how to deal with possible problems in the sale of real estate. First of all, we should trust only authoritative agencies that are interested in the profitable sale of your apartment, because it will directly affect the income of the realtors themselves. To ensure that the speed of the transaction does not conflict with the benefit and the quality of the performance of the transaction, the first thing to ask is, what will be expected of the prospective buyer of the transaction and what will help him decide to buy?

The sale contract is a complex legal document, and it is important for the parties to comply with the existing law in the process of formulating it, with particular care in drafting the basic terms and conditions, such as the deposit, the value of the property, and the value of the property. It is often the case that the price of the dwelling has been overstated or underestimated by the parties to the contract, that such action may have serious negative consequences for both the seller and the buyer. In making the sale transaction, the inventory value of the dwelling must be taken into account, as well as the likelihood that tax payments may arise. As the price of the contract for the sale of the dwelling is determined, the determination of the value of the dwelling is essential. The price of the property is an essential condition of the contract and should be included in the contract, otherwise the document will be considered as non-concluded at all, even if all the other terms of the written agreement have been complied with.

How quickly and beneficial is it to sell an apartment, and what do you take into account when selling real estate?

.

.

.

.

.

.

.

.

2

2

It's such a cool site.

Thank you so much for the information, and now I'm not gonna make that mistake.

I'd add a few more things, of course, but basically everything is said.