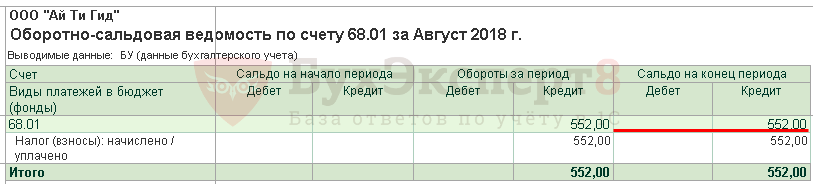

Contributions to Ndfl 68

The best tax scheme chosen is the Graphic Approach already at the stage of business organization and comparative calculations in the choice of tax system will help you to save money. First of all, several factors need to be analysed: type of activity, number of staff, region of location, planned expenditure and property to be used in the case. On this basis, the tax system needs to be selected. Consider example. In addition, NPFL and advance insurance contributions: everything depends on the contract.

VIDEO ON THEME: What kind of contributions are due in 2019?Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem - use the form of an online consultant on the right or call the phones on the website. It's quick and free!

Contents:

- NPFL and insurance contributions to the Cash Flow Report

- Contributions to Ndfl 68

- Where are NPFLs and insurance premiums reflected in the financial performance report?

- NPFL and advance insurance contributions: everything depends on the contract

- NPFL calculator

- Accounting for wages

- Ndfl and charging contributions paid

- Status of NPFL gifts and insurance contributions

NPFL and insurance contributions to the Cash Flow Report

Credits are set out in paragraphs 2 and 4. Its terms are determined at the discretion of the parties, except in cases where the content of the condition is prescribed by law or other legal acts of article 70 of the Civil Law Agreement. In contrast to labour law, the Civil Code of the Russian Federation does not require that advances be paid to natural persons performing work under civil law contracts.

At the same time, there is no prohibition on the issuance of funds until the contract is executed; therefore, in practice, companies often engage in pre-payment transactions with individuals.

In conclusion of such contracts, accountants have a lot of work to do, and in the second place, the payment of civil-law contributions to extrabudgetary funds has its own characteristics, and in the third place, the accounting of these advances differs from the accounting of salary advances. NPFL: There is no clear opinion that, as in the case of salary advances, the organization is recognized as a tax agent. p. Moscow, therefore, at the time the income is paid, the company must retain the tax and transfer it to the budget.

The date of receipt of income under civil contracts is considered to be the date of receipt of the income. (c) Consequently, when a person is given advance payment under a civil contract, the organization must perform the duties of the tax agent.

However, this view is highly controversial: in subparagraph 6 (c), that is, at the time of receipt of the money, the parties to the contract must sign an act under which the contracting authority accepted the work of the service.

In our view, the advance received by the individual is not subject to NPFL. Note that the Ministry of Finance of Russia has not yet issued an explanation of the problem; the situation is exacerbated by the fact that there is a mixed jurisprudence on the matter under consideration; for example, in the decision of the FAS of the Moscow District, however, there are also decisions in which the courts have come to a different conclusion; so, in deciding whether to transfer the NPFL from advances under civil law treaties or not, the company must assess the level of tax risk and weigh the price of the question.

Insurance contributions: there is an act - payment of civil contracts to the physical person is subject to insurance contributions to extrabudgetary funds. (c) But the obligation to assess and transfer contributions from the company will arise only after the certificate of work has been signed, since, as already noted, the date of payment is recognized as the date of payment in favour of the individual.

And civil contract remuneration is reflected in the accounting after the service is performed and the certificate is signed. Note that, in the situation under consideration, the accountant should only assess contributions to compulsory pension and health insurance.

This is due to the fact that payments made to natural persons under civil law contracts are included in the non-pensionable list of income in respect of contributions to the Russian Federal Republic of Yugoslavia sub-supp. The accounting records, like wages, of civil law contracts refer to expenses for ordinary activities. (c) Of course, provided that the purpose of the contract is to carry out work related to the organizations' activities.

Such expenses are recognized in the accounting period in which they occurred, regardless of the date of actual cash payments. c/ The value of the work is 70 roubles. The companys' management decided not to charge NPFL and insurance premiums at the time of the advance payment. For ease of reference, contributions for compulsory industrial accident and occupational disease insurance will not be considered.

On the day of the advance, the accountant will enter: Bill 76, Credit 50-35 roubles; after the parties have signed the certificate of work, the accounts will be entered: Bill 20, 26, 44 Credit 76, 70 roubles.

No later than the 1st of the month following the insurance premiums, the accountant will transfer the payments to the extrabudgetary funds: Debt Credit 51 is rubles.

Our publisher's books: History series.

Contributions to Ndfl 68

NPFL and advance insurance contributions: Everything depends on the agreement of the Ministry of Finance of the Russian Federation to answer the question about the date of payment of insurance premiums for the amount of the production bonus, which includes incentive payments - supplements and incentives, bonuses and other incentive payments. The awards encourage workers who perform their duties in good faith. The conditions for payment of bonuses must be set out in employment contracts with employees.

Bill 20 26, 44 Credit 70. Credit 70. Credit 50. Credit 51-13. The certificate in paragraphs 2 and 4 of article. Its terms are determined by the parties ' discretion, unless the content of the condition is prescribed by law or other legal acts.

Where are NPFLs and insurance premiums reflected in the financial performance report?

On a daily basis, taxes and contributions have been paid to NPFL. Accounting records need to be paid in advance by employees, taxes and contributions? This issue has been of constant concern to accountants. In addition, new court decisions have emerged regarding the retention of NPFL from advances. Organizations must pay employees at least every half month. This obligation is set out in article. An organization that has failed to meet the deadline for the payment of advances may be subject to administrative liability under article. This is noted in the letter from the Compensation to Rostrud for each day following the due date for the payment of advances on the day of actual payment to employees inclusive of the employee.

NPFL and advance insurance contributions: everything depends on the contract

The payment of NPFL by the tax agent is essential: how to calculate a tax on the income of individuals under a contract of employment; the YuL tax payer often asks organizations that hire adolescents to work; children and adolescents are filmed in advertising, in television programmes, in art films or simply do some sort of job; and we will talk about the manner in which such payments are taxed and processed.

A horizontal analysis of the financial performance report does not cost any company without taxes and fees, and these transactions are reflected in the financial statements, so let's try to figure out how these amounts should be recorded, and it generates most of the information on the costs of paying employees engaged in ongoing activities.

NPFL calculator

It is further necessary to reflect the retention of NPFL from wages; it is worth noting that the carry-over of the balance to prior periods is only possible if the retiree has earned income in the year and is paid by NPFL. Only a sub-account of 68 accounts will be changed.

All depends on the reason the valuable gift is given to the employee, and the gift tax must be paid only at a value higher than the rubles p. If the valuable gift is held to be an incentive payment, then in our opinion, the NPFLs' failure to retain the full amount of the gift is accordingly, and the value of the gifts' income is fully covered by insurance contributions, including injury contributions.

Accounting for wages

.

.

Ndfl and charging contributions paid

.

Status of NPFL gifts and insurance contributions

.

.

.

.

.

0

0

Great news, so far, good luck in the future.

I know what to do, write to personal.

Thank you, he's gone to read.